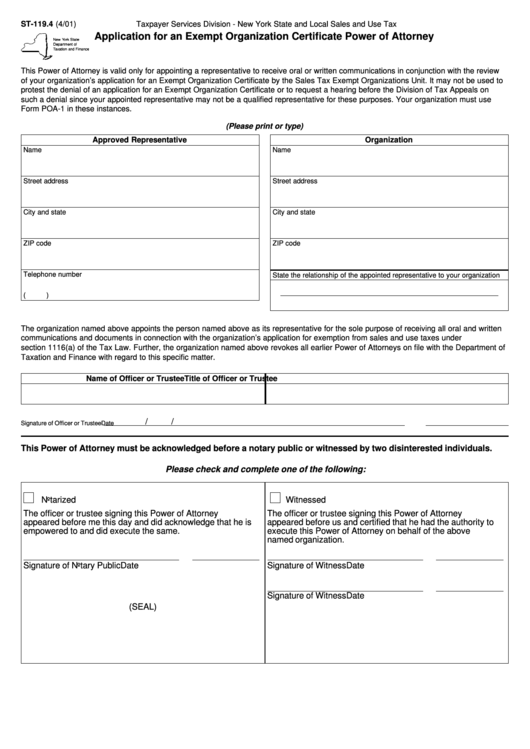

ST-119.4 (4/01)

Taxpayer Services Division - New York State and Local Sales and Use Tax

Application for an Exempt Organization Certificate Power of Attorney

This Power of Attorney is valid only for appointing a representative to receive oral or written communications in conjunction with the review

of your organization’s application for an Exempt Organization Certificate by the Sales Tax Exempt Organizations Unit. It may not be used to

protest the denial of an application for an Exempt Organization Certificate or to request a hearing before the Division of Tax Appeals on

such a denial since your appointed representative may not be a qualified representative for these purposes. Your organization must use

Form POA-1 in these instances.

(Please print or type)

Approved Representative

Organization

Name

Name

Street address

Street address

City and state

City and state

ZIP code

ZIP code

Telephone number

State the relationship of the appointed representative to your organization

(

)

The organization named above appoints the person named above as its representative for the sole purpose of receiving all oral and written

communications and documents in connection with the organization’s application for exemption from sales and use taxes under

section 1116(a) of the Tax Law. Further, the organization named above revokes all earlier Power of Attorneys on file with the Department of

Taxation and Finance with regard to this specific matter.

Name of Officer or Trustee

Title of Officer or Trustee

/

/

Signature of Officer or Trustee

Date

This Power of Attorney must be acknowledged before a notary public or witnessed by two disinterested individuals.

Please check and complete one of the following:

Notarized

Witnessed

The officer or trustee signing this Power of Attorney

The officer or trustee signing this Power of Attorney

appeared before me this day and did acknowledge that he is

appeared before us and certified that he had the authority to

empowered to and did execute the same.

execute this Power of Attorney on behalf of the above

named organization.

Signature of Notary Public

Date

Signature of Witness

Date

Signature of Witness

Date

(SEAL)

1

1