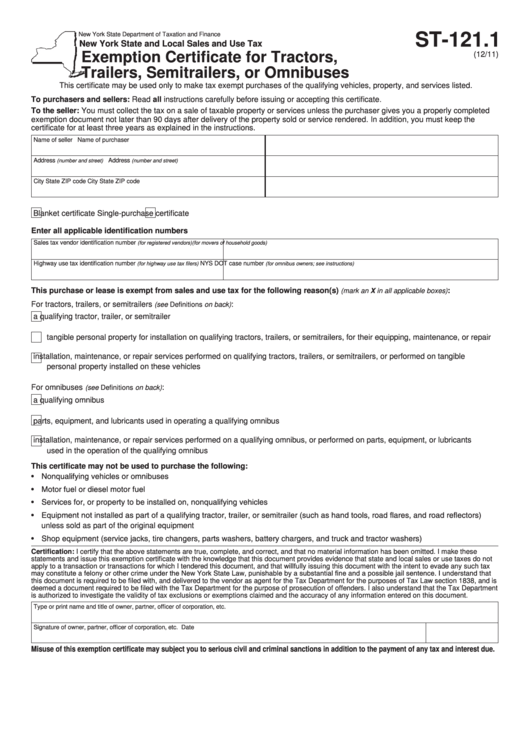

New York State Department of Taxation and Finance

ST-121.1

New York State and Local Sales and Use Tax

Exemption Certificate for Tractors,

(12/11)

Trailers, Semitrailers, or Omnibuses

This certificate may be used only to make tax exempt purchases of the qualifying vehicles, property, and services listed.

To purchasers and sellers: Read all instructions carefully before issuing or accepting this certificate.

To the seller: You must collect the tax on a sale of taxable property or services unless the purchaser gives you a properly completed

exemption document not later than 90 days after delivery of the property sold or service rendered. In addition, you must keep the

certificate for at least three years as explained in the instructions.

Name of seller

Name of purchaser

Address

Address

(number and street)

(number and street)

City

State

ZIP code

City

State

ZIP code

Blanket certificate

Single-purchase certificate

Enter all applicable identification numbers

Sales tax vendor identification number

U.S. Department of Transportation number

(for registered vendors)

(for movers of household goods)

Highway use tax identification number

NYS DOT case number

(for highway use tax filers)

(for omnibus owners; see instructions)

This purchase or lease is exempt from sales and use tax for the following reason(s)

:

(mark an X in all applicable boxes)

For tractors, trailers, or semitrailers

:

(see Definitions on back)

a qualifying tractor, trailer, or semitrailer

tangible personal property for installation on qualifying tractors, trailers, or semitrailers, for their equipping, maintenance, or repair

installation, maintenance, or repair services performed on qualifying tractors, trailers, or semitrailers, or performed on tangible

personal property installed on these vehicles

For omnibuses

:

(see Definitions on back)

a qualifying omnibus

parts, equipment, and lubricants used in operating a qualifying omnibus

installation, maintenance, or repair services performed on a qualifying omnibus, or performed on parts, equipment, or lubricants

used in the operation of the qualifying omnibus

This certificate may not be used to purchase the following:

• Nonqualifying vehicles or omnibuses

• Motor fuel or diesel motor fuel

• Services for, or property to be installed on, nonqualifying vehicles

• Equipment not installed as part of a qualifying tractor, trailer, or semitrailer (such as hand tools, road flares, and road reflectors)

unless sold as part of the original equipment

• Shop equipment (service jacks, tire changers, parts washers, battery chargers, and truck and tractor washers)

Certification: I certify that the above statements are true, complete, and correct, and that no material information has been omitted. I make these

statements and issue this exemption certificate with the knowledge that this document provides evidence that state and local sales or use taxes do not

apply to a transaction or transactions for which I tendered this document, and that willfully issuing this document with the intent to evade any such tax

may constitute a felony or other crime under the New York State Law, punishable by a substantial fine and a possible jail sentence. I understand that

this document is required to be filed with, and delivered to the vendor as agent for the Tax Department for the purposes of Tax Law section 1838, and is

deemed a document required to be filed with the Tax Department for the purpose of prosecution of offenders. I also understand that the Tax Department

is authorized to investigate the validity of tax exclusions or exemptions claimed and the accuracy of any information entered on this document.

Type or print name and title of owner, partner, officer of corporation, etc.

Signature of owner, partner, officer of corporation, etc.

Date

Misuse of this exemption certificate may subject you to serious civil and criminal sanctions in addition to the payment of any tax and interest due.

1

1 2

2