Form St-810.10 - Quarterly Schedule Fr For Part-Quarterly (Monthly) Filers - Sales And Use Tax On Qualified Motor Fuel And Highway Diesel Motor Fuel - 2015 Page 3

ADVERTISEMENT

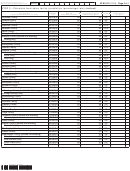

Quarterly Schedule FR for

0916

Sales tax identification number

ST-810.10 (11/15) Page 3 of 4

Part-Quarterly (Monthly) Filers

STEP 5 – Calculate local sales tax by jurisdiction (percentage rate)

(continued)

Column A

Column B

Column C

Column D

Column E

Column F

Taxing jurisdiction

Jurisdiction

Motor fuel

Highway diesel motor fuel

×

Tax rate

=

Sales and use tax

+

code

taxable sales and self-use

taxable sales and self-use

(C + D) x E

(Jurisdictions are listed in county order)

Genesee County

GE R1834

.00

.00

4%

Greene County

GR R1924

.00

.00

4%

Hamilton County

HA R2024

.00

.00

4%

Herkimer County

HE R2124

.00

.00

4¼%

Jefferson County

JE R2205

.00

.00

3¾%

Lewis County

LE R2314

.00

.00

4%

Livingston County

LI R2414

.00

.00

4%

Madison County (outside the following)

MA R2504

.00

.00

4%

Oneida (city)

ON R2534

.00

.00

4%

Monroe County

MO R2614

.00

.00

4%

Montgomery County

MO R2744

.00

.00

4%

Nassau County

NA R2834

.00

.00

4¼%

Niagara County

NI R2924

.00

.00

4%

Oneida County (outside the following)

ON R3034

.00

.00

4¾%

Rome (city)

RO R3083

.00

.00

4¾%

Utica (city)

UT R3094

.00

.00

4¾%

Onondaga County

ON R3126

.00

.00

4%

Ontario County

ON R3286

.00

.00

3½%

Orange County

OR R3334

.00

.00

3¾%

Orleans County

OR R3414

.00

.00

4%

Oswego County (outside the following)

OS R3564

.00

.00

4%

Oswego (city)

OS R3554

.00

.00

4%

Otsego County

OT R3624

.00

.00

4%

Putnam County

PU R3744

.00

.00

4%

Rensselaer County

RE R3804

.00

.00

4%

Rockland County

RO R3958

.00

.00

4%

St. Lawrence County

ST R4004

.00

.00

4%

Saratoga County (outside the following)

SA R4104

.00

.00

3%

Saratoga Springs (city)

SA R4134

.00

.00

3%

Schenectady County

SC R4284

.00

.00

4%

Schoharie County

SC R4314

.00

.00

4%

Schuyler County

SC R4414

.00

.00

4%

Steuben County

ST R4604

.00

.00

4%

Suffolk County

SU R4754

.00

.00

4¼%

Sullivan County

SU R4804

.00

.00

4%

Tioga County

TI R4924

.00

.00

4%

Tompkins County (outside the following)

TO R5024

.00

.00

4%

Ithaca (city)

IT R5034

.00

.00

4%

Ulster County

UL R5124

.00

.00

4%

Warren County (outside the following)

WA R5204

.00

.00

3%

Glens Falls (city)

GL R5224

.00

.00

3%

Washington County

WA R5314

.00

.00

3%

Wayne County

WA R5414

.00

.00

4%

Westchester County (outside the following)

WE R5514

.00

.00

3%

Mount Vernon (city)

MO R5534

.00

.00

4%

New Rochelle (city)

NE R6834

.00

.00

4%

White Plains (city)

WH R6508

.00

.00

4%

Yonkers (city)

YO R6514

.00

.00

4½%

81000311150094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4