1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

4

4

-

-

-

5

X X X X X X X X X

X X X X X X X X X

5

SSN

FEIN

6

6

7

7

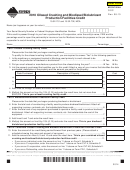

Part IV. Combined Oilseed Crushing and Biodiesel/Biolubricant Production Facilities Credit

8

8

10. Enter the amount of tax credit being carried forward from previous years. (Please

9

9

290

include a schedule showing the years and amount of carryover.) .................................10.

10

10

11. Add the amounts on lines 5, 9 and 10 and enter the result here. This is your combined

11

11

300

oilseed crushing and biodiesel/biolubricant production facilities credit. ............. 11.

12

12

13

13

Where to Report Your Credit

14

14

15

15

► Individuals: Form 2, Schedule V

► S corporations: Form CLT-4S, Schedule II

16

16

► C corporations: Form CIT, Schedule C

► Partnerships: Form PR-1, Schedule II

17

17

18

18

19

19

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically,

20

20

you represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

21

21

22

22

23

23

24

24

25

25

26

26

27

27

Form OSC Instructions

28

28

29

29

Biodiesel is a fuel produced from monoalkyl esters of long-

If you file electronically, you do not need to mail this form to

30

30

chain fatty acids derived from vegetable oils, renewable

us unless we contact you for a copy.

31

31

lipids, animal fats, or any combination of these ingredients.

Am I subject to recapturing the credit that I previously

32

32

This fuel must meet the requirements of ASTM D6751, also

received if I cease operating my business?

33

33

known as the Standard Specification for Biodiesel Fuel

Yes, you are. If you cease operating your business for a

34

34

(B-100) Blend Stock for Distillate Fuels, as adopted by the

period of 12 continuous months, within five years from the

35

35

American Society for Testing and Materials.

year you claimed the credit, you are required to recapture

36

36

Biolubricant is a product, other than food or feed,

this credit in the year you ceased operations.

37

37

substantially composed of certain biological products,

38

38

If my business is a partnership or an S corporation,

agricultural materials or forestry materials. The product is

39

39

are my partners or shareholders entitled to the oilseed

used in place of a petroleum-based lubricant.

40

40

crushing and biodiesel/biolubricant production

What information do I have to include with my tax

41

41

facilities credit?

return when I claim this credit?

42

42

As a partnership, your partners are entitled to apply these

43

43

●

Individuals. If you are filing a paper return, include

credits against their income tax or corporate income tax

44

44

a copy of Form OSC with your individual income tax

liability.

45

45

return.

As an S corporation, the shareholders are entitled to apply

46

46

●

C corporations. If you are filing a paper return, include

these credits against their income tax or corporate income

47

47

a copy of Form OSC with your corporate income tax

tax liability. The amount of each shareholder’s credit is

48

48

return.

based on their pro rata share of the corporation’s cost of

49

49

investing in equipment or the facility.

50

●

S corporations and partnerships. If you are an

50

51

entity taxed as an S corporation or a partnership and

51

Part I. Partners in a Partnership or Shareholders

are claiming this credit, include Form OSC with your

52

52

of an S Corporation

53

Montana information return Form CLT-4S or PR-1 and

53

54

include a separate statement identifying each owner

54

How do I claim my credit when I am a partner or

55

and their share.

55

shareholder in a partnership or S corporation?

56

56

You will need to complete a separate Form OSC for each

If you received this credit from a partnership or S

57

57

source you are receiving the credit from. For example, if

corporation, you will need to fill out Part I in its entirety.

58

58

you are a partner in one partnership that qualifies for this

Your portion of the credit can be obtained from the Montana

59

59

credit, and you, as an individual, also qualify for this credit,

Schedule K-1 that you received from the entity. In addition

60

60

you would need to complete two forms.

to reporting your portion of the credit, you will need to

61

61

provide the partnership’s or S corporation’s name and

62

62

Federal Employer Identification Number.

63

63

64

64

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2 3

3