Form OP-383 Instructions

Conn. Gen. Stat. §12-692 applies the rental surcharge to the

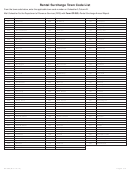

Schedule A Instructions

rental of any private passenger motor vehicle and any rental

For each private passenger motor vehicle and rental truck, enter

truck at the rate of 3% for the term of 30 consecutive calendar days

the appropriate information in Columns A, B, C, E, F, and G. For

or less. See Policy Statement 2002(5), The Motor Vehicle Rental

each piece of machinery, enter the appropriate information in

Surcharge and the Tourism Account Surcharge.

Columns A, B, D, E, F, and G.

Conn. Gen. Stat. §12-692 also applies the rental surcharge to

Column A: Enter the vehicle identifi cation number of each private

the daily rental of machinery at the rate of 1½% for a term of 30

passenger motor vehicle, rental truck, or piece of

consecutive calendar days or less. For the purpose of the rental

machinery, if applicable, you used for rental purposes

surcharge on a daily rental of machinery, the period for the term of a

during calendar year 2012. If the piece of machinery

machinery rental begins on the date a piece of machinery is rented

has no vehicle identifi cation number, enter a brief

to a lessee and terminates on the date the piece of machinery is

description of the machinery such as bulldozer,

returned to the rental company. Therefore, if a rental of a piece of

crane, etc.

machinery is renewed before the machinery is returned to the rental

company, the term of the renewal is added to the term of the initial

Column B: Enter the town code from Page 4 for the Connecticut

rental to determine the rental period. If the initial rental of a piece of

municipality to which personal property taxes were paid

machinery is for a term of 30 consecutive calendar days or less, and

on the private passenger motor vehicle, rental truck, or

after adding the renewal term to the initial term, the rental period is

piece of machinery during calendar year 2012.

more than 30 consecutive calendar days, the rental is not subject

Column C: Enter the amount subject to the 3% rental surcharge

to the rental surcharge.

you received from rental of the private passenger motor

Machinery means heavy equipment that may be used for

vehicle or rental truck during calendar year 2012. Enter

construction, mining, or forestry including but not limited to

the total of Column C on Form OP-383, Line 1.

bulldozers, earthmoving equipment, well-drilling machinery and

Column D: Enter the amount subject to the 1.5% rental surcharge

equipment, or cranes. See Policy Statement 2007(3), Rental

you received from rental of pieces of machinery during

Surcharge – Daily Rental of Machinery.

calendar year 2012. Enter the total of Column D on

Filing Instructions

Form OP-383, Line 2. Column D should not include

the rental surcharge collected on the initial machinery

Send Form OP-383, Rental Surcharge Annual Report, and

Schedule A to the Department of Revenue Services (DRS) on

rental and refunded to the lessee because the rental

or before February 15, 2013. If the due date falls on a Saturday,

period was more than 30 consecutive calendar days

Sunday, or legal holiday, the next business day is the due date.

after the machinery rental was renewed.

Complete the report in blue or black ink only.

Column E: Enter the rental surcharge you actually collected on

Complete Schedule A fi rst and enter the information as instructed

rentals of the private passenger motor vehicle, rental

on the appropriate lines of Form OP-383.

truck, or piece of machinery during calendar year 2012.

This amount should equal 3% of the amount entered in

Mail to:

Department of Revenue Services

Column C or 1.5% of the amount entered in Column D.

State of Connecticut

Enter the total of Column E on Form OP-383, Line 3.

PO Box 5030

Hartford CT 06102-5030

Column F: If you own the private passenger motor vehicle, rental

truck, or piece of machinery, enter the personal property

Keep a copy of Form OP-383, Schedule A, and supporting

taxes you paid to the Connecticut municipality identifi ed

documentation related to property taxes, registration, and titling

in Column B during calendar year 2012. If you do not

fees actually paid during calendar year 2012 for at least three years.

own the private passenger motor vehicle, rental truck,

Rounding Off to Whole Dollars: You must round off cents to the

or piece of machinery, but lease it from another person

nearest whole dollar on your returns and schedules. If you do not

for rental purposes and the lease requires you to pay

round, DRS will disregard the cents. Round down to the next lowest

those property taxes on the vehicle to that other person,

dollar all amounts that include 1 through 49 cents. Round up to the

enter the personal property taxes you paid to that

next highest dollar all amounts that include 50 through 99 cents.

other person during calendar year 2012. Enter the total

of Column F on Form OP-383, Line 4.

Pay Electronically: Visit to use the Taxpayer

Service Center (TSC) to make a direct tax payment. After logging

Column G: If you own the private passenger motor vehicle, rental

into the TSC, select the Make Payment Only option and choose

truck, or piece of machinery, enter the registration and

a tax type from the drop down box. Using this option authorizes

titling fees you paid to the Connecticut Department

DRS to electronically withdraw a payment from your bank account

of Motor Vehicles (DMV), if any, during calendar year

(checking or savings) on a date you select up to the due date. As a

2012. If you do not own the private passenger motor

reminder, even if you pay electronically you must still fi le your report

vehicle, rental truck, or piece of machinery, but lease it

by the due date. Surcharge not paid on or before the due date will

from another person for rental purposes and the lease

be subject to penalty and interest.

requires you to pay those registration and titling fees on

the vehicle or machinery to that other person, enter the

Interest: In general, interest applies to any portion of the surcharge

registration and titling fees you paid during calendar year

not paid on or before the original due date of the return. If you do not

2012 to that other person. Enter the total of Column G on

pay the surcharge when due, you will owe interest at the rate of 1%

Form OP-383, Line 5.

per month or fraction of a month until the surcharge is paid in full.

Late Payment Penalty: The penalty for underpayment of surcharge

is 15% of the surcharge not paid on or before the original due date

of the report or $50, whichever is greater.

Page 3 of 4

OP-383 (Rev. 12/12)

1

1 2

2 3

3 4

4