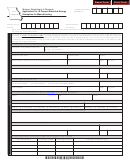

Part C - Determination of Exempt and Taxable Purchases

Columns 1, 2 and 5 are from suppliers’ billings.

Column 6 is obtained from previously filed sales tax returns.

Column 7 is obtained by subtracting (5A + 6A) from 4A.

Column 3 is obtained by multiplying Column 2 by the exempt percentage in Part B.

Column 4 is obtained by multiplying Column 2 by the taxable percentage in Part B.

Column 8 is obtained by subtracting (5B + 6B) from 4B.

Billing Portion on Which

Taxable Amount

Billing Portion On Which Sales

Tax Is Due Taxable Equipment

Sales Tax Was Paid to Suppliers

Previously Reported

7. Taxable

8. Local Only

2. Total Billing

3. Billing Portion

4b. At Local

Period

1. Total

5a. At Full

5b. At Local

6a. At Full

6b. At Local

Balance to be

Taxable Balance

4a. At Full

for Exempt

Exclusive

Only

Reported on

to be Reported

By Month

KWH Billed

Tax Rate

Tax Rate

Tax Rate

Tax Rate

Tax Rate

Equipment

Tax Rate

of Sales Tax

Page 1 (Full Rate)

on Page 1

January

February

March

April

May

June

July

August

September

October

November

December

$

$

$

$

$

$

$

$

$

$

Total

Section 144.054.2, RSMo

This form presumes that the electricity used in manufacturing under

is at least 76% of total usage and therefore, 100% exempt from state tax

after August 27, 2007. If not, then additional calculations not shown here are necessary to determine the amount of electricity to report subject to the full sales tax rate

and the amount of electricity to report subject to the local tax rate only. If you have any questions, please contact the Department of Revenue at (573) 751-2836.

Form 53-E10 (Revised 12-2013)

Mail to:

Taxation Division

Phone: (573) 751-9409

Visit

TDD: (800) 735-2966

P.O. Box 840

for additional information.

Fax: (573) 751-9409

Jefferson City, MO 65105-0840

E-mail:

salesuse@dor.mo.gov

1

1 2

2 3

3