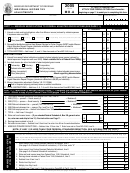

PART 3 - PENSION AND SOCIAL SECURITY/SOCIAL SECURITY DISABILITY/MILITARY EXEMPTION

PUBLIC PENSION CALCULATION

Pensions received from any federal, state, or local government.

—

1

00

1. Missouri adjusted gross income from Form MO‑1040, Line 6 .............................................................................................

2

00

2. Taxable social security benefits from Federal Form 1040A, Line 14b or Federal Form 1040, Line 20b .............................

3

00

3. Subtract Line 2 from Line 1 ..................................................................................................................................................

4. Select the appropriate filing status and enter amount on Line 4. Married filing combined ‑ $100,000; Single, Head of

4

00

Household, Married Filing Separate, and Qualifying Widow ‑ $85,000 ................................................................................

5

00

5. Subtract Line 4 from Line 3 and enter on Line 5. If Line 4 is greater than Line 3, enter $0 ................................................

Y - YOURSELF

S - SPOUSE

6. Taxable pension for each spouse from public sources from Federal Form 1040A, Line 12b or 1040, Line 16b ...............

6Y

00 6S

00

7. Multiply Line 6 by 100% .......................................................................................................................................................

7Y

00 7S

00

8. Amount from Line 7 or $35,234 (maximum social security benefit), whichever is less. .......................................................

8Y

00 8S

00

9. Amount from Line 6 or $6,000, whichever is less ................................................................................................................

9Y

00 9S

00

10Y

00 10S

00

10. Amount from Line 8 or Line 9, whichever is greater .............................................................................................................

11. If you received taxable social security complete Lines 1 through 8 of Section C and enter the amount(s) from Line(s)

11Y

00 11S

00

6Y and 6S. See instructions if Line 3 of Section C is more than $0. ....................................................................................

12Y

00 12S

00

12. Subtract Line 11 from Line 10. If Line 11 is greater than Line 10, enter $0 ........................................................................

13

00

13. Add amounts on Lines 12Y and 12S ....................................................................................................................................

14. Total public pension, subtract Line 5, from Line 13. If Line 5 is greater than Line 13, enter $0 .......................................

14

00

PRIVATE PENSION CALCULATION

Annuities, pensions, IRA’S, and 401(k) plans funded by a private source.

—

1. Missouri adjusted gross income from Form MO‑1040, Line 6 ............................................................................................

1

00

2. Taxable social security benefits from Federal Form 1040A, Line 14b or Federal Form 1040, Line 20b ............................

2

00

3. Subtract Line 2 from Line 1. ................................................................................................................................................

3

00

4. Select the appropriate filing status and enter the amount on Line 4: Married filing combined: $32,000; Single,

4

00

Head of Household and Qualifying Widower: $25,000; Married Filing Separate: $16,000 .....................................

5. Subtract Line 4 from Line 3. If Line 4 is greater than Line 3, enter $0 ...............................................................................

5

00

S - SPOUSE

Y - YOURSELF

6. Taxable pension for each spouse from private sources from Federal Form 1040A, Lines 11b and 12b, or Federal

6Y

00 6S

00

Form 1040, Lines 15b and 16b. .........................................................................................................................................

7Y

00 7S

00

7. Amounts from Line 6Y and 6S or $6,000, whichever is less ..............................................................................................

8

00

8. Add Lines 7Y and 7S ..........................................................................................................................................................

9. Total private pension, subtract Line 5 from Line 8. If Line 5 is greater than Line 8, enter $0 ........................................

9

00

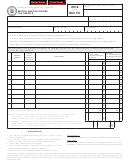

SOCIAL SECURITY OR SOCIAL SECURITY DISABILITY CALCULATION

— To be eligible for social security deduction you must be 62 years of age

by December 31 and have marked the 62 and older box on page 1 of Form MO-1040. Age limit does not apply to social security disability deduction.

1. Missouri adjusted gross income from Form MO‑1040, Line 6 ............................................................................................

1

00

2. Select the appropriate filing status and enter the amount on Line 2. Married filing combined ‑ $100,000

Single, Head of Household, Married Filing Separate, and Qualifying Widower ‑ $85,000 ..........................................

2

00

3

00

3. Subtract Line 2 from Line 1 and enter on Line 3. If Line 2 is greater than Line 1, enter $0 ................................................

Y - YOURSELF

S - SPOUSE

4. Taxable social security benefits for each spouse from Federal Form 1040A, Line 14b or Federal Form 1040, Line 20b ......

4Y

00 4S

00

5. Taxable social security disability benefits for each spouse from Federal Form 1040A, Line 14b or 1040, Line 20b. ................

5Y

00 5S

00

6. Multiply Line 4 or Line 5 by 100%. ......................................................................................................................................

6Y

00 6S

00

7. Add Lines 6Y and 6S ..........................................................................................................................................................

7

00

8. Total social security/social security disability, subtract Line 3 from Line 7. If Line 3 is greater than Line 7, enter $0. ........

8

00

MILITARY PENSION CALCULATION

1. Military retirement benefits included on Federal Form 1040A, Line 12b or Federal Form 1040, Line 16b .........................

1

00

2. Taxable public pension from Federal Form 1040A, Line 12b or Federal Form 1040, Line 16b. .....................................

2

00

3. Divide Line 1 by Line 2 (Round to whole number) ..............................................................................................................

3

%

4. Multiply Line 3 by Line 14 of Section A. If you are not claiming a public pension exemption, enter $0 .............................

4

00

5. Subtract Line 4 from Line 1 .................................................................................................................................................

5

00

6. Total military pension, multiply Line 5 by 45%. ................................................................................................................

6

00

TOTAL PENSION AND SOCIAL SECURITY/SOCIAL SECURITY DISABILITY/MILITARY EXEMPTION

Add Line 14 (Section A), Line 9 (Section B), Line 8 (Section C), and Line 6 (Section D).

TOTAL

Enter total amount here and on Form MO-1040, Line 8. ...............................................................................................

EXEMPTION

00

MO-A (12-2012)

1

1 2

2