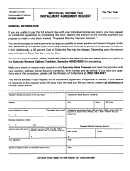

INDIVIDUAL INCOME TAX

INSTALLMENT AGREEMENT REQUEST

GENERAL INFORMATION

A Kentucky taxpayer has the right to consideration of an

Income Tax Installment Agreement Request, and

installment agreement for the payment of delinquent

attach an original Form 12A200 to the front of the

taxes, interest, penalties and fees. The right to an

return. This form is color coded for easy recognition

installment agreement is provided for in KRS 131.081(9)

during processing. Copies will delay processing and

and is primarily dependent on the taxpayer’s inability

may result in additional penalties and interest. The

to pay the amount due in full.

Department of Revenue will make every effort to

acknowledge the request within 90 days. If you do not

Eligibility for an Installment Agreement

receive a response to this request within 90 days from

the date you file your return, please call the Division of

An installment agreement should be requested only

Collections, (502) 564-4921, ext. 5354.

when there is no other way of paying the liability on

time.

State Tax Lien

A taxpayer must clearly demonstrate an inability to pay

Depending on the amount and length of the agreement,

the liability in full and the agreement must facilitate

a State Tax Lien may be filed. If a lien is filed, it will

collection. Generally this means that taxpayers who

remain on the taxpayer’s credit record for up to

have the ability to pay with available funds or borrow

seven years after the liability is paid and the lien is

from a financial institution are not eligible.

released.

Proposed Monthly Payment Amount

Making Payment

The monthly payment amount will be based upon the

Interest, penalties and fees may be reduced by making

taxpayer’s ability to pay after considering the taxpayer’s

a partial payment with the return or making payments

monthly income and reasonable expenses. Allowable

prior to obtaining a payment agreement. When making

expenses generally include reasonable amounts for

payments, please include the taxpayer’s name(s),

food, clothing, housing (and associated expenses),

Social Security number(s), tax period and the type

installment payments and other necessary living

tax being paid. Checks should be made payable to the

expenses. The proposed monthly payment amount

Kentucky State Treasurer and mailed to the Division

should be as much as possible to minimize the length

of Collections at the address below. For ACH Debits

of the agreement and the accrual of interest, penalties

(automatic electronic withdrawals from a checking

and fees.

account) or credit card payments, see Form 12A200.

Interest, Penalties, Fees and Refund Offsets

Assistance

The law provides for the assessment of interest,

Questions should be directed to:

penalties and fees for tax liabilities paid after the

due date. Interest accrues at the tax interest rate (6

Division of Collections

percent for 2013). In addition, penalties of 2 percent

Kentucky Department of Revenue

per month may be assessed on the unpaid tax. A 25

P.O. Box 491

percent Cost of Collection Fee is imposed on tax due

Frankfort, KY 40602-0491

which becomes due and payable (generally 46 days

(502) 564-4921, ext. 5354

after the assessment date). Interest, penalties and fees

continue to accumulate while an installment agreement

Form 12A200, Individual Income Tax Installment

is in place. Also, any money Kentucky may owe you

Agreement Request, is available at Kentucky Taxpayer

(tax refunds, etc.) will be offset to your outstanding

Service Centers located throughout the commonwealth.

liability. Additionally, any federal income tax refund

Forms may also be obtained from the Internet at

that may become due to you may be offset to this

, or by contacting the Division of

liability pursuant to 26 USC §6402(e). Penalties and

Collections or:

fees may be waived or reduced if the taxpayer files the

return on time, honors the payment agreement and/or

FORMS

demonstrates reasonable cause.

Operations and Support Services Branches

Setting up the Agreement

Kentucky Department of Revenue

501 High Street

Taxpayers who believe they qualify for an installment

Frankfort, KY 40620

agreement should complete Form 12A200, Individual

(502) 564-3658

1

1 2

2