GENERAL INSTRUCTIONS

If you are unable to pay the full amount due with your individual income tax return, you may request an installment

agreement by completing this form and attaching it to the front of your return. Specify the amount of the monthly

payment you propose to make in the block marked “Proposed Monthly Payment Amount. ” Payments should be as

large as possible to lower penalty and interest charges.

You can make installment payments in three ways. Credit cards or ACH Debits will save you the time and trouble of

mailing monthly payments and may help save you additional penalties, interest or fees.

•

Pay by Credit Card—To charge your monthly payments to MasterCard, VISA, American Express or Discover

provide the account number and other information on the form below. You must also provide the cardholder’s

name and billing address exactly as it appears on the credit card billing statement. You may also arrange

credit card installments by phone. For more information, call (502) 564-4921, ext. 5354. A convenience fee

may apply to each monthly payment. Please indicate date for credit card payment.

•

Pay by ACH Debit—To request that your monthly payments be withdrawn electronically from a bank account,

attach a voided check to the completed form below. You may also call (502) 564-4921, ext. 5354 to request

this option. Please indicate date for ACH Debit payment.

•

Pay by Mail—Make your checks or money orders payable to the Kentucky State Treasurer. Include the

taxpayer’s full name(s), Social Security number(s), and the tax period you are paying. Mail the payments

to the Division of Collections, P .O. Box 491, Frankfort, KY 40602-0491.

You will be advised if your request for an installment agreement is approved or denied. If you do not receive a

response to this request within 90 days from the date you file your return, please call the Division of Collections,

(502) 564-4921, ext. 5354.

CUT HERE

✄

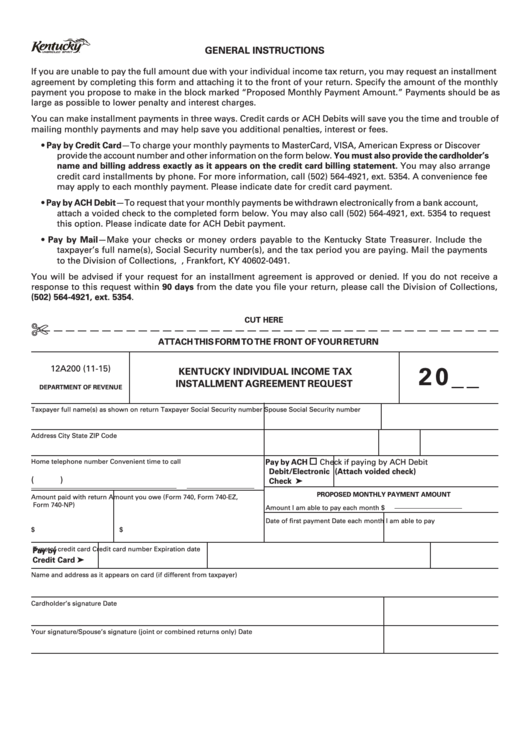

ATTACH THIS FORM TO THE FRONT OF YOUR RETURN

2 0 _ _

12A200 (11-15)

KENTUCKY INDIVIDUAL INCOME TAX

INSTALLMENT AGREEMENT REQUEST

DEPARTMENT OF REVENUE

Taxpayer full name(s) as shown on return

Taxpayer Social Security number

Spouse Social Security number

Address

City

State

ZIP Code

Pay by ACH

Check if paying by ACH Debit

Home telephone number

Convenient time to call

Debit/Electronic

(Attach voided check)

(

)

Check ➤

PROPOSED MONTHLY PAYMENT AMOUNT

Amount paid with return

Amount you owe (Form 740, Form 740-EZ,

Form 740-NP)

Amount I am able to pay each month $

Date of first payment

Date each month I am able to pay

$

$

Type of credit card

Credit card number

Expiration date

Pay by

Credit Card ➤

Name and address as it appears on card (if different from taxpayer)

Cardholder’s signature

Date

Your signature/Spouse’s signature (joint or combined returns only)

Date

1

1 2

2