Form Dtf-664 - Tax Shelter Disclosure For Material Advisors - 2011

ADVERTISEMENT

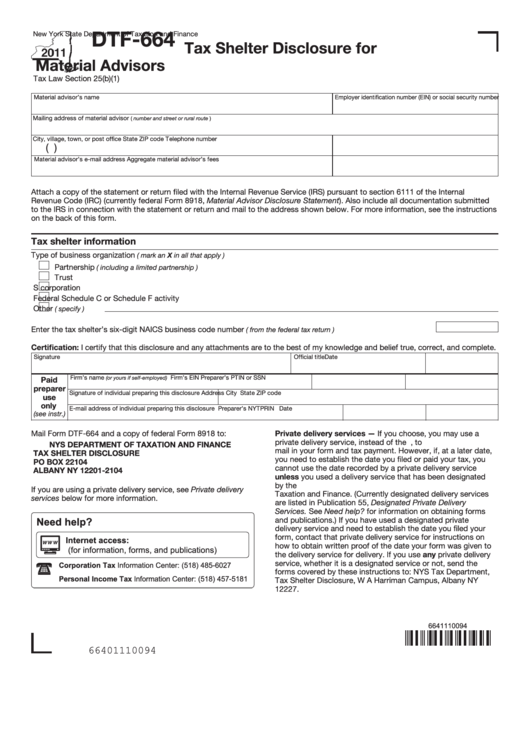

DTF-664

New York State Department of Taxation and Finance

Tax Shelter Disclosure for

Material Advisors

Tax Law Section 25(b)(1)

Material advisor’s name

Employer identification number (EIN) or social security number

Mailing address of material advisor

( number and street or rural route )

City, village, town, or post office

State

ZIP code

Telephone number

(

)

Material advisor’s e-mail address

Aggregate material advisor’s fees

Attach a copy of the statement or return filed with the Internal Revenue Service (IRS) pursuant to section 6111 of the Internal

Revenue Code (IRC) (currently federal Form 8918, Material Advisor Disclosure Statement) . Also include all documentation submitted

to the IRS in connection with the statement or return and mail to the address shown below. For more information, see the instructions

on the back of this form.

Tax shelter information

Type of business organization

( mark an X in all that apply )

Partnership

( including a limited partnership )

Trust

S corporation

Federal Schedule C or Schedule F activity

Other

( specify )

Enter the tax shelter’s six-digit NAICS business code number

..............................................

( from the federal tax return )

Certification: I certify that this disclosure and any attachments are to the best of my knowledge and belief true, correct, and complete.

Signature

Official title

Date

Firm’s name

Firm’s EIN

Preparer’s PTIN or SSN

(or yours if self-employed)

Paid

preparer

Signature of individual preparing this disclosure

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this disclosure

Preparer’s NYTPRIN

Date

(see instr.)

Mail Form DTF-664 and a copy of federal Form 8918 to:

Private delivery services — If you choose, you may use a

private delivery service, instead of the U.S. Postal Service, to

NYS DEPARTMENT OF TAXATION AND FINANCE

mail in your form and tax payment. However, if, at a later date,

TAX SHELTER DISCLOSURE

you need to establish the date you filed or paid your tax, you

PO BOX 22104

cannot use the date recorded by a private delivery service

ALBANY NY 12201-2104

unless you used a delivery service that has been designated

by the U.S. Secretary of the Treasury or the Commissioner of

If you are using a private delivery service, see Private delivery

Taxation and Finance. (Currently designated delivery services

services below for more information.

are listed in Publication 55, Designated Private Delivery

Services. See Need help? for information on obtaining forms

Need help?

and publications.) If you have used a designated private

delivery service and need to establish the date you filed your

form, contact that private delivery service for instructions on

Internet access:

how to obtain written proof of the date your form was given to

(for information, forms, and publications)

the delivery service for delivery. If you use any private delivery

service, whether it is a designated service or not, send the

Corporation Tax Information Center:

(518) 485-6027

forms covered by these instructions to: NYS Tax Department,

Personal Income Tax Information Center: (518) 457-5181

Tax Shelter Disclosure, W A Harriman Campus, Albany NY

12227.

6641110094

66401110094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2