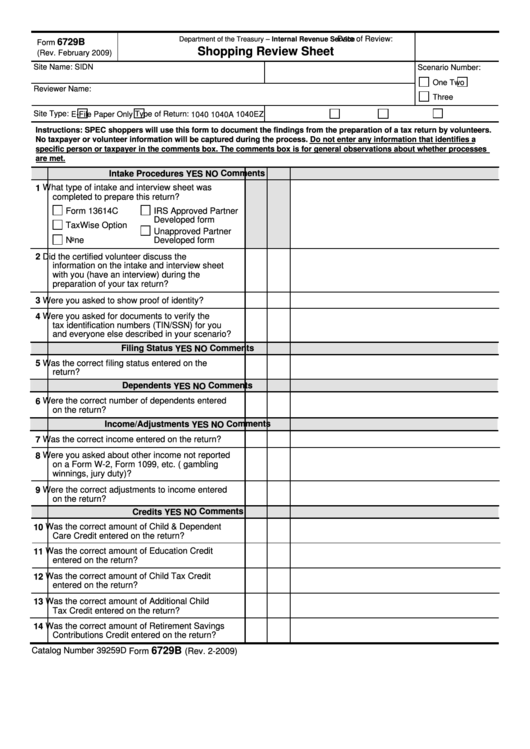

Date of Review:

Department of the Treasury – Internal Revenue Service

6729B

Form

Shopping Review Sheet

(Rev. February 2009)

Site Name:

SIDN

Scenario Number:

One

Two

Reviewer Name:

Three

Site Type:

E-File

Paper Only

Type of Return:

1040EZ

1040

1040A

Instructions: SPEC shoppers will use this form to document the findings from the preparation of a tax return by volunteers.

No taxpayer or volunteer information will be captured during the process. Do not enter any information that identifies a

specific person or taxpayer in the comments box. The comments box is for general observations about whether processes

are met.

Intake Procedures

Comments

YES NO

What type of intake and interview sheet was

1

completed to prepare this return?

Form 13614C

IRS Approved Partner

Developed form

TaxWise Option

Unapproved Partner

None

Developed form

2

Did the certified volunteer discuss the

information on the intake and interview sheet

with you (have an interview) during the

preparation of your tax return?

3

Were you asked to show proof of identity?

4

Were you asked for documents to verify the

tax identification numbers (TIN/SSN) for you

and everyone else described in your scenario?

Filing Status

Comments

YES NO

5

Was the correct filing status entered on the

return?

Dependents

Comments

YES NO

Were the correct number of dependents entered

6

on the return?

Income/Adjustments

Comments

YES NO

Was the correct income entered on the return?

7

Were you asked about other income not reported

8

on a Form W-2, Form 1099, etc. (i.e. gambling

winnings, jury duty)?

Were the correct adjustments to income entered

9

on the return?

Comments

Credits

YES NO

10 Was the correct amount of Child & Dependent

Care Credit entered on the return?

11 Was the correct amount of Education Credit

entered on the return?

12 Was the correct amount of Child Tax Credit

entered on the return?

13 Was the correct amount of Additional Child

Tax Credit entered on the return?

14 Was the correct amount of Retirement Savings

Contributions Credit entered on the return?

6729B

Catalog Number 39259D

Form

(Rev. 2-2009)

1

1 2

2