Form 1099 Workers Information Sheet

ADVERTISEMENT

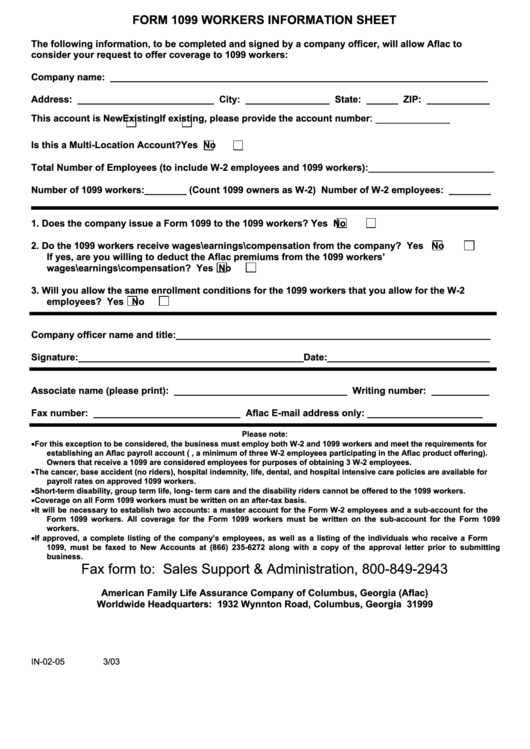

FORM 1099 WORKERS INFORMATION SHEET

The following information, to be completed and signed by a company officer, will allow Aflac to

consider your request to offer coverage to 1099 workers:

Company name: ________________________________________________________________________

Address: __________________________ City: ________________ State: ______ ZIP: ____________

: _____________

This account is New

Existing

If existing, please provide the account number

Is this a Multi-Location Account? Yes

No

Total Number of Employees (to include W-2 employees and 1099 workers):________________________

Number of 1099 workers:________ (Count 1099 owners as W-2) Number of W-2 employees: ________

1. Does the company issue a Form 1099 to the 1099 workers? Yes

No

2. Do the 1099 workers receive wages\earnings\compensation from the company? Yes

No

If yes, are you willing to deduct the Aflac premiums from the 1099 workers’

wages\earnings\compensation? Yes

No

3. Will you allow the same enrollment conditions for the 1099 workers that you allow for the W-2

employees? Yes

No

Company officer name and title:____________________________________________________________

Signature:___________________________________________Date:_______________________________

Associate name (please print): _________________________________ Writing number: ___________

Fax number: ____________________________ Aflac E-mail address only: ______________________

Please note:

•

For this exception to be considered, the business must employ both W-2 and 1099 workers and meet the requirements for

establishing an Aflac payroll account (i.e., a minimum of three W-2 employees participating in the Aflac product offering).

Owners that receive a 1099 are considered employees for purposes of obtaining 3 W-2 employees.

•

The cancer, base accident (no riders), hospital indemnity, life, dental, and hospital intensive care policies are available for

payroll rates on approved 1099 workers.

•

Short-term disability, group term life, long- term care and the disability riders cannot be offered to the 1099 workers.

•

Coverage on all Form 1099 workers must be written on an after-tax basis.

•

It will be necessary to establish two accounts: a master account for the Form W-2 employees and a sub-account for the

Form 1099 workers. All coverage for the Form 1099 workers must be written on the sub-account for the Form 1099

workers.

•

If approved, a complete listing of the company’s employees, as well as a listing of the individuals who receive a Form

1099, must be faxed to New Accounts at (866) 235-6272 along with a copy of the approval letter prior to submitting

business.

Fax form to: Sales Support & Administration, 800-849-2943

American Family Life Assurance Company of Columbus, Georgia (Aflac)

Worldwide Headquarters: 1932 Wynnton Road, Columbus, Georgia 31999

IN-02-05

3/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1