Form 44-016 - Employee'S Statement Of Nonresidence In Iowa

ADVERTISEMENT

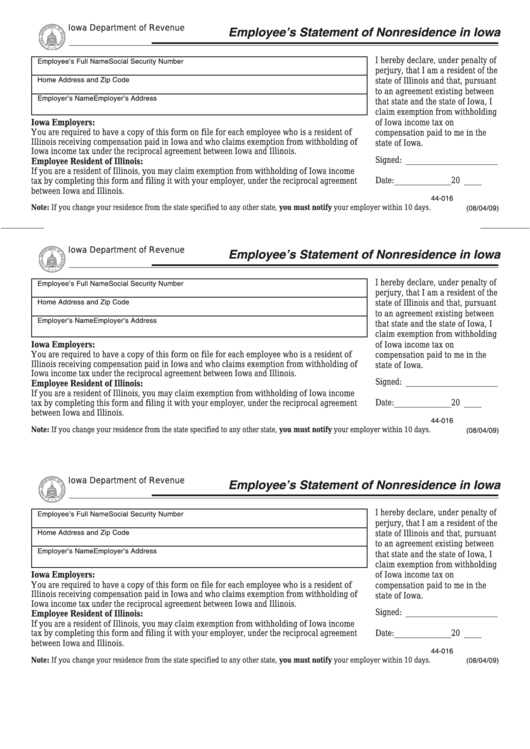

Iowa Department of Revenue

Employee’s Statement of Nonresidence in Iowa

Employee’s Full Name

Social Security Number

I hereby declare, under penalty of

perjury, that I am a resident of the

Home Address and Zip Code

state of Illinois and that, pursuant

to an agreement existing between

Employer’s Name

Employer’s Address

that state and the state of Iowa, I

claim exemption from withholding

Iowa Employers:

of Iowa income tax on

You are required to have a copy of this form on file for each employee who is a resident of

compensation paid to me in the

Illinois receiving compensation paid in Iowa and who claims exemption from withholding of

state of Iowa.

Iowa income tax under the reciprocal agreement between Iowa and Illinois.

Signed: _____________________

Employee Resident of Illinois:

If you are a resident of Illinois, you may claim exemption from withholding of Iowa income

Date: _____________ 20 ____

tax by completing this form and filing it with your employer, under the reciprocal agreement

between Iowa and Illinois.

44-016

(08/04/09)

Note: If you change your residence from the state specified to any other state, you must notify your employer within 10 days.

Iowa Department of Revenue

Employee’s Statement of Nonresidence in Iowa

Employee’s Full Name

Social Security Number

I hereby declare, under penalty of

perjury, that I am a resident of the

Home Address and Zip Code

state of Illinois and that, pursuant

to an agreement existing between

Employer’s Name

Employer’s Address

that state and the state of Iowa, I

claim exemption from withholding

Iowa Employers:

of Iowa income tax on

You are required to have a copy of this form on file for each employee who is a resident of

compensation paid to me in the

Illinois receiving compensation paid in Iowa and who claims exemption from withholding of

state of Iowa.

Iowa income tax under the reciprocal agreement between Iowa and Illinois.

Signed: _____________________

Employee Resident of Illinois:

If you are a resident of Illinois, you may claim exemption from withholding of Iowa income

Date: _____________ 20 ____

tax by completing this form and filing it with your employer, under the reciprocal agreement

between Iowa and Illinois.

44-016

(08/04/09)

Note: If you change your residence from the state specified to any other state, you must notify your employer within 10 days.

Iowa Department of Revenue

Employee’s Statement of Nonresidence in Iowa

Employee’s Full Name

Social Security Number

I hereby declare, under penalty of

perjury, that I am a resident of the

Home Address and Zip Code

state of Illinois and that, pursuant

to an agreement existing between

Employer’s Name

Employer’s Address

that state and the state of Iowa, I

claim exemption from withholding

of Iowa income tax on

Iowa Employers:

You are required to have a copy of this form on file for each employee who is a resident of

compensation paid to me in the

Illinois receiving compensation paid in Iowa and who claims exemption from withholding of

state of Iowa.

Iowa income tax under the reciprocal agreement between Iowa and Illinois.

Signed: _____________________

Employee Resident of Illinois:

If you are a resident of Illinois, you may claim exemption from withholding of Iowa income

tax by completing this form and filing it with your employer, under the reciprocal agreement

Date: _____________ 20 ____

between Iowa and Illinois.

44-016

(08/04/09)

Note: If you change your residence from the state specified to any other state, you must notify your employer within 10 days.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1