Form Ct-500 - Corporation Tax Credit Deferral - 2012 Page 4

ADVERTISEMENT

Page 4 of 6 CT-500 (2012)

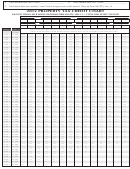

Schedule E – Article 9-A – General business corporations

Computation of credits used and refunded

9 Tax due before credits from Form CT-3, line 78, or CT-3-A, line 77, plus any net recaptured tax credits

9

10 Total nonrefundable credits allowed against the tax

......................................................

10

(from line 7)

11 Tax due after application of nonrefundable credits

.................................................

11

(see instructions)

12 Total refundable credits allowed for the current tax year

...............................................

12

(from line 8)

13 Tax after application of credits

................................................................................

13

(see instructions)

14 Refundable tax credits

............................................................................................

14

(see instructions)

15 Amount of line 14 to be refunded

............................................................................

15

(see instructions)

16 Amount of line 14 to be applied as an overpayment to next year’s tax

..................

16

(see instructions)

17 Total refund eligible credits

.....................................................................................

17

(see instructions)

18 Divide line 11 by line 12

....................................................

18

(round to 6 decimal places; see instructions)

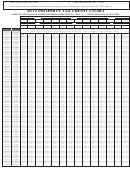

Schedule F – Article 33 – Life insurance and non-life insurance corporations

Form CT-33 and Form CT-33-A filers, including unauthorized insurance corporations

Parts 1 and 2

–

Part 1 – Computation of EZ and ZEA credits used against the tax

If you are claiming any EZ or ZEA wage tax credits or the EZ capital tax credit, complete this part; otherwise complete your Form CT-33

to line 11 or Form CT-33-A to line 15 and begin with Part 2 below.

19 Tax due before EZ and ZEA credits from Form CT-33, line 9a, or CT-33-A, line 10, plus any

net recaptured tax credits .............................................................................................................

19

20 Total amount of EZ and ZEA wage tax credits and EZ capital tax credit used against

the tax

.................................................................................................................

20

(see instructions)

21 Tax due after application of EZ credits

....................................................................

(see instructions)

21

Part 2 – Computation of other credits used and refunded

22 Tax from Form CT-33, line 11, or CT-33-A, line 15, plus any net recaptured tax credits .................

22

23 Total nonrefundable credits allowed against the tax

......................................................

23

(from line 7)

24 Nonrefundable credits allowed against the tax, excluding EZ credits

...

24

(subtract line 20 from line 23)

25 Tax due after application of nonrefundable credits allowed

....................................

25

(see instructions)

26 Total refundable credits allowed for the current tax year

...............................................

26

(from line 8)

27 Tax due after application of credits

.........................................................................

27

(see instructions)

28 Refundable tax credits

............................................................................................

28

(see instructions)

29 Amount of line 28 to be refunded

............................................................................

29

(see instructions)

30 Amount of line 28 to be applied as an overpayment to next year’s tax

..................

30

(see instructions)

31 Total refund eligible credits

.....................................................................................

31

(see instructions)

32 Divide line 25 by line 26

....................................................

(round to 6 decimal places; see instructions)

32

Part 3 – Non-life insurance corporations (Form CT-33-NL filers)

33 Tax due before credits from Form CT-33-NL, line 5, plus any net recaptured tax credits ...............

33

34 Total nonrefundable credits allowed against the tax

......................................................

34

(from line 7)

35 Tax due after application of nonrefundable credits

.................................................

35

(see instructions)

36 Total refundable credits allowed for the current tax year

...............................................

36

(from line 8)

37 Tax due after application of credits

.........................................................................

37

(see instructions)

38 Refundable tax credits

............................................................................................

38

(see instructions)

39 Amount of line 38 to be refunded

............................................................................

39

(see instructions)

40 Amount of line 38 to be applied as an overpayment to next year’s tax

..................

40

(see instructions)

41 Total refund eligible credits

.....................................................................................

41

(see instructions)

42 Divide line 35 by line 36

....................................................

42

(round to 6 decimal places; see instructions)

534004120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6