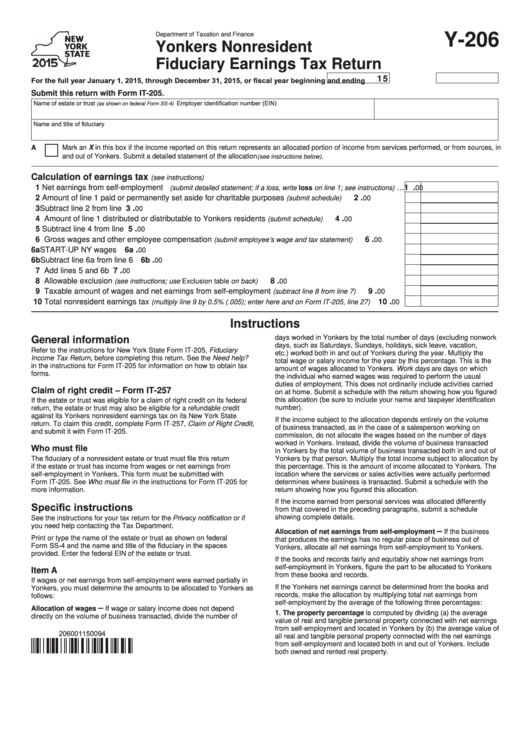

Department of taxation and Finance

Y-206

Yonkers Nonresident

Fiduciary Earnings Tax Return

1 5

For the full year January 1, 2015, through December 31, 2015, or fiscal year beginning

and ending

Submit this return with Form IT-205.

Employer identification number (EIN)

Name of estate or trust

(as shown on federal Form SS-4)

Name and title of fiduciary

A

Mark an X in this box if the income reported on this return represents an allocated portion of income from services performed, or from sources, in

and out of Yonkers. Submit a detailed statement of the allocation

(see instructions below).

Calculation of earnings tax

(see instructions)

.

1 Net earnings from self-employment

...

1

(submit detailed statement; if a loss, write loss on line 1; see instructions)

00

.

2 Amount of line 1 paid or permanently set aside for charitable purposes

.........................

2

(submit schedule)

00

.

3 Subtract line 2 from line 1...........................................................................................................................

3

00

.

4 Amount of line 1 distributed or distributable to Yonkers residents

...................................

4

(submit schedule)

00

.

5 Subtract line 4 from line 3...........................................................................................................................

5

00

.

6 Gross wages and other employee compensation

.....................

6

(submit employee’s wage and tax statement)

00

.

6a StArt-up NY wages ................................................................................................................................ 6a

00

.

6b Subtract line 6a from line 6 ........................................................................................................................ 6b

00

.

7 Add lines 5 and 6b .....................................................................................................................................

7

00

.

8 Allowable exclusion

.................................................................

8

(see instructions; use Exclusion table on back)

00

.

9 taxable amount of wages and net earnings from self-employment

....................

9

(subtract line 8 from line 7)

00

.

10 total nonresident earnings tax

.............. 10

(multiply line 9 by 0.5% (.005); enter here and on Form IT-205, line 27)

00

Instructions

days worked in Yonkers by the total number of days (excluding nonwork

General information

days, such as Saturdays, Sundays, holidays, sick leave, vacation,

refer to the instructions for New York State Form It-205, Fiduciary

etc.) worked both in and out of Yonkers during the year. Multiply the

Income Tax Return, before completing this return. See the Need help?

total wage or salary income for the year by this percentage. this is the

in the instructions for Form It-205 for information on how to obtain tax

amount of wages allocated to Yonkers. Work days are days on which

forms.

the individual who earned wages was required to perform the usual

duties of employment. this does not ordinarily include activities carried

Claim of right credit – Form IT-257

on at home. Submit a schedule with the return showing how you figured

this allocation (be sure to include your name and taxpayer identification

If the estate or trust was eligible for a claim of right credit on its federal

number).

return, the estate or trust may also be eligible for a refundable credit

against its Yonkers nonresident earnings tax on its New York State

If the income subject to the allocation depends entirely on the volume

return. to claim this credit, complete Form It-257, Claim of Right Credit,

of business transacted, as in the case of a salesperson working on

and submit it with Form It-205.

commission, do not allocate the wages based on the number of days

worked in Yonkers. Instead, divide the volume of business transacted

Who must file

in Yonkers by the total volume of business transacted both in and out of

The fiduciary of a nonresident estate or trust must file this return

Yonkers by that person. Multiply the total income subject to allocation by

if the estate or trust has income from wages or net earnings from

this percentage. this is the amount of income allocated to Yonkers. the

self-employment in Yonkers. this form must be submitted with

location where the services or sales activities were actually performed

Form It-205. See Who must file in the instructions for Form It-205 for

determines where business is transacted. Submit a schedule with the

return showing how you figured this allocation.

more information.

If the income earned from personal services was allocated differently

Specific instructions

from that covered in the preceding paragraphs, submit a schedule

See the instructions for your tax return for the Privacy notification or if

showing complete details.

you need help contacting the tax Department.

–

Allocation of net earnings from self-employment

If the business

print or type the name of the estate or trust as shown on federal

that produces the earnings has no regular place of business out of

Form SS-4 and the name and title of the fiduciary in the spaces

Yonkers, allocate all net earnings from self-employment to Yonkers.

provided. Enter the federal EIN of the estate or trust.

If the books and records fairly and equitably show net earnings from

self-employment in Yonkers, figure the part to be allocated to Yonkers

Item A

from these books and records.

If wages or net earnings from self-employment were earned partially in

If the Yonkers net earnings cannot be determined from the books and

Yonkers, you must determine the amounts to be allocated to Yonkers as

records, make the allocation by multiplying total net earnings from

follows:

self-employment by the average of the following three percentages:

–

Allocation of wages

If wage or salary income does not depend

1. The property percentage is computed by dividing (a) the average

directly on the volume of business transacted, divide the number of

value of real and tangible personal property connected with net earnings

from self-employment and located in Yonkers by (b) the average value of

206001150094

all real and tangible personal property connected with the net earnings

from self-employment and located both in and out of Yonkers. Include

both owned and rented real property.

1

1 2

2