Reset Form

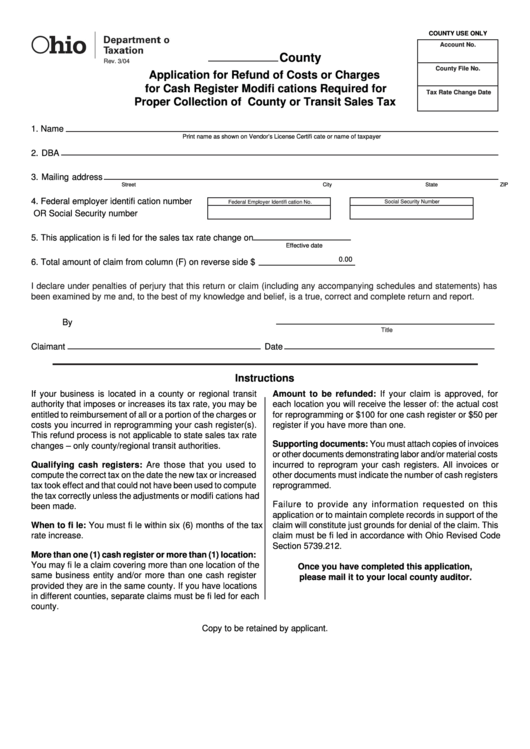

COUNTY USE ONLY

Account No.

County

Rev. 3/04

County File No.

Application for Refund of Costs or Charges

for Cash Register Modifi cations Required for

Tax Rate Change Date

Proper Collection of County or Transit Sales Tax

1. Name

Print name as shown on Vendor’s License Certifi cate or name of taxpayer

2. DBA

3. Mailing address

Street

City

State

ZIP code

4. Federal employer identifi cation number

Federal Employer Identifi cation No.

Social Security Number

OR Social Security number

5. This application is fi led for the sales tax rate change on

Effective date

0.00

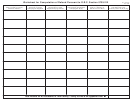

6. Total amount of claim from column (F) on reverse side $

I declare under penalties of perjury that this return or claim (including any accompanying schedules and statements) has

been examined by me and, to the best of my knowledge and belief, is a true, correct and complete return and report.

By

Title

Claimant

Date

Instructions

If your business is located in a county or regional transit

Amount to be refunded: If your claim is approved, for

authority that imposes or increases its tax rate, you may be

each location you will receive the lesser of: the actual cost

entitled to reimbursement of all or a portion of the charges or

for reprogramming or $100 for one cash register or $50 per

costs you incurred in reprogramming your cash register(s).

register if you have more than one.

This refund process is not applicable to state sales tax rate

Supporting documents: You must attach copies of invoices

changes – only county/regional transit authorities.

or other documents demonstrating labor and/or material costs

Qualifying cash registers: Are those that you used to

incurred to reprogram your cash registers. All invoices or

compute the correct tax on the date the new tax or increased

other documents must indicate the number of cash registers

tax took effect and that could not have been used to compute

reprogrammed.

the tax correctly unless the adjustments or modifi cations had

Failure to provide any information requested on this

been made.

application or to maintain complete records in support of the

When to fi le: You must fi le within six (6) months of the tax

claim will constitute just grounds for denial of the claim. This

rate increase.

claim must be fi led in accordance with Ohio Revised Code

Section 5739.212.

More than one (1) cash register or more than (1) location:

You may fi le a claim covering more than one location of the

Once you have completed this application,

same business entity and/or more than one cash register

please mail it to your local county auditor.

provided they are in the same county. If you have locations

in different counties, separate claims must be fi led for each

county.

Copy to be retained by applicant.

1

1 2

2