Form Rf 1-2000 - Application For Municipal Income Tax Refund

ADVERTISEMENT

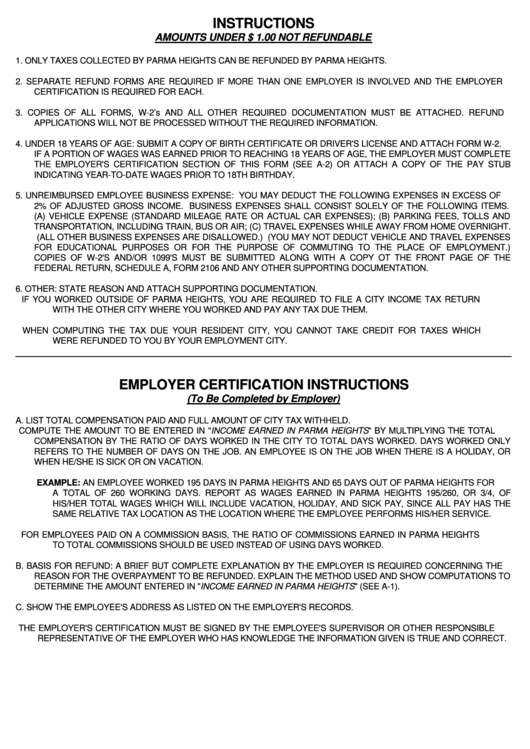

INSTRUCTIONS

AMOUNTS UNDER $ 1.00 NOT REFUNDABLE

1.

ONLY TAXES COLLECTED BY PARMA HEIGHTS CAN BE REFUNDED BY PARMA HEIGHTS.

2.

SEPARATE REFUND FORMS ARE REQUIRED IF MORE THAN ONE EMPLOYER IS INVOLVED AND THE EMPLOYER

CERTIFICATION IS REQUIRED FOR EACH.

3.

COPIES OF ALL FORMS, W-2’s AND ALL OTHER REQUIRED DOCUMENTATION MUST BE ATTACHED. REFUND

APPLICATIONS WILL NOT BE PROCESSED WITHOUT THE REQUIRED INFORMATION.

4.

UNDER 18 YEARS OF AGE: SUBMIT A COPY OF BIRTH CERTIFICATE OR DRIVER'S LICENSE AND ATTACH FORM W-2.

IF A PORTION OF WAGES WAS EARNED PRIOR TO REACHING 18 YEARS OF AGE, THE EMPLOYER MUST COMPLETE

THE EMPLOYER'S CERTIFICATION SECTION OF THIS FORM (SEE A-2) OR ATTACH A COPY OF THE PAY STUB

INDICATING YEAR-TO-DATE WAGES PRIOR TO 18TH BIRTHDAY.

5.

UNREIMBURSED EMPLOYEE BUSINESS EXPENSE: YOU MAY DEDUCT THE FOLLOWING EXPENSES IN EXCESS OF

2% OF ADJUSTED GROSS INCOME. BUSINESS EXPENSES SHALL CONSIST SOLELY OF THE FOLLOWING ITEMS.

(A) VEHICLE EXPENSE (STANDARD MILEAGE RATE OR ACTUAL CAR EXPENSES); (B) PARKING FEES, TOLLS AND

TRANSPORTATION, INCLUDING TRAIN, BUS OR AIR; (C) TRAVEL EXPENSES WHILE AWAY FROM HOME OVERNIGHT.

(ALL OTHER BUSINESS EXPENSES ARE DISALLOWED.) (YOU MAY NOT DEDUCT VEHICLE AND TRAVEL EXPENSES

FOR EDUCATIONAL PURPOSES OR FOR THE PURPOSE OF COMMUTING TO THE PLACE OF EMPLOYMENT.)

COPIES OF W-2'S AND/OR 1099'S MUST BE SUBMITTED ALONG WITH A COPY OT THE FRONT PAGE OF THE

FEDERAL RETURN, SCHEDULE A, FORM 2106 AND ANY OTHER SUPPORTING DOCUMENTATION.

6.

OTHER: STATE REASON AND ATTACH SUPPORTING DOCUMENTATION.

IF YOU WORKED OUTSIDE OF PARMA HEIGHTS, YOU ARE REQUIRED TO FILE A CITY INCOME TAX RETURN

WITH THE OTHER CITY WHERE YOU WORKED AND PAY ANY TAX DUE THEM.

WHEN COMPUTING THE TAX DUE YOUR RESIDENT CITY, YOU CANNOT TAKE CREDIT FOR TAXES WHICH

WERE REFUNDED TO YOU BY YOUR EMPLOYMENT CITY.

EMPLOYER CERTIFICATION INSTRUCTIONS

(To Be Completed by Employer)

A.

LIST TOTAL COMPENSATION PAID AND FULL AMOUNT OF CITY TAX WITHHELD.

COMPUTE THE AMOUNT TO BE ENTERED IN "INCOME EARNED IN PARMA HEIGHTS" BY MULTIPLYING THE TOTAL

COMPENSATION BY THE RATIO OF DAYS WORKED IN THE CITY TO TOTAL DAYS WORKED. DAYS WORKED ONLY

REFERS TO THE NUMBER OF DAYS ON THE JOB. AN EMPLOYEE IS ON THE JOB WHEN THERE IS A HOLIDAY, OR

WHEN HE/SHE IS SICK OR ON VACATION.

EXAMPLE: AN EMPLOYEE WORKED 195 DAYS IN PARMA HEIGHTS AND 65 DAYS OUT OF PARMA HEIGHTS FOR

A TOTAL OF 260 WORKING DAYS. REPORT AS WAGES EARNED IN PARMA HEIGHTS 195/260, OR 3/4, OF

HIS/HER TOTAL WAGES WHICH WILL INCLUDE VACATION, HOLIDAY, AND SICK PAY, SINCE ALL PAY HAS THE

SAME RELATIVE TAX LOCATION AS THE LOCATION WHERE THE EMPLOYEE PERFORMS HIS/HER SERVICE.

FOR EMPLOYEES PAID ON A COMMISSION BASIS, THE RATIO OF COMMISSIONS EARNED IN PARMA HEIGHTS

TO TOTAL COMMISSIONS SHOULD BE USED INSTEAD OF USING DAYS WORKED.

B.

BASIS FOR REFUND: A BRIEF BUT COMPLETE EXPLANATION BY THE EMPLOYER IS REQUIRED CONCERNING THE

REASON FOR THE OVERPAYMENT TO BE REFUNDED. EXPLAIN THE METHOD USED AND SHOW COMPUTATIONS TO

DETERMINE THE AMOUNT ENTERED IN "INCOME EARNED IN PARMA HEIGHTS" (SEE A-1).

C.

SHOW THE EMPLOYEE'S ADDRESS AS LISTED ON THE EMPLOYER'S RECORDS.

THE EMPLOYER'S CERTIFICATION MUST BE SIGNED BY THE EMPLOYEE'S SUPERVISOR OR OTHER RESPONSIBLE

REPRESENTATIVE OF THE EMPLOYER WHO HAS KNOWLEDGE THE INFORMATION GIVEN IS TRUE AND CORRECT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2