General Information on Annualizing

If the income of an estate or trust fluctuates or is seasonal, a fiduciary may be able to lower the amount of one or more

required estimated tax installments by annualizing the income. To see if an estate or trust can pay less for any period,

first complete the Fiduciary Estimated Income Tax Worksheet (Form ESW-FID), then complete the Fiduciary Estimated

Tax Annualization Worksheet (Form ESA-FID). Complete one column before continuing on to the next. This worksheet

annualizes the tax at the end of each period based on a reasonable estimate of income and deductions from the

beginning of the tax year through the end of each period. If a fiduciary uses the annualized income worksheet for any

payment due date, a fiduciary has to use it for all subsequent payment due dates. If a fiduciary uses the annualized

income installment method, then include the Form ESA-FID with the estate or trust’s tax return if filing on paper.

Form ESA-FID Instructions

To figure the amount of each required installment, the worksheet selects the smaller of the annualized income installment

or the regular installment (that has been increased by the amount saved by using the annualized income installment

method in figuring any earlier installments).

Line 1 For each period (column), figure the total income including adjustments to income. Include income or loss items

from partnerships or S corporations for the period.

Line 2 For each period (column), figure the total income distribution deduction.

Line 6 To compute the tax, use the tax table below.

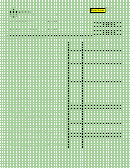

2014 Montana Individual Income Tax Table

If Your Taxable

Multiply

If Your Taxable

Multiply

But Not

And

This Is

But Not

And

This Is

Income Is

Your Taxable

Income Is

Your Taxable

More Than

Subtract

Your Tax

More Than

Subtract

Your Tax

More Than

Income By

More Than

Income By

$0

$2,800

1% (0.010)

$0

$10,300

$13,300

5% (0.050)

$257

$2,800

$5,000

2% (0.020)

$28

$13,300

$17,100

6% (0.060)

$390

$5,000

$7,600

3% (0.030)

$78

More Than $17,100

6.9% (0.069)

$544

$7,600

$10,300

4% (0.040)

$154

For example:

Taxable income $6,800 X 3% (0.030) = $204.

$204 minus $78 = $126 tax

Administrative Rules of Montana: 42.17.305, 42.17.308 and 42.17.309

Questions? Please call us toll free at (866) 859-2254 (in Helena, 444-6900).

1

1 2

2