Instructions For Form 6390 - Alaska Federal-Based Credits - 2013

ADVERTISEMENT

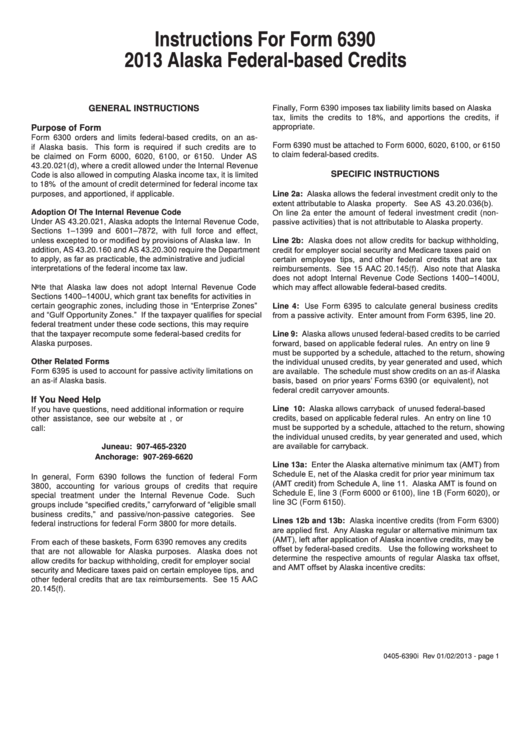

Instructions For Form 6390

2013 Alaska Federal-based Credits

Finally, Form 6390 imposes tax liability limits based on Alaska

GENERAL INSTRUCTIONS

tax, limits the credits to 18%, and apportions the credits, if

appropriate.

Purpose of Form

Form 6300 orders and limits federal-based credits, on an as-

Form 6390 must be attached to Form 6000, 6020, 6100, or 6150

if Alaska basis. This form is required if such credits are to

to claim federal-based credits.

be claimed on Form 6000, 6020, 6100, or 6150. Under AS

43.20.021(d), where a credit allowed under the Internal Revenue

SPECIFIC INSTRUCTIONS

Code is also allowed in computing Alaska income tax, it is limited

to 18% of the amount of credit determined for federal income tax

Line 2a: Alaska allows the federal investment credit only to the

purposes, and apportioned, if applicable.

extent attributable to Alaska property. See AS 43.20.036(b).

Adoption Of The Internal Revenue Code

On line 2a enter the amount of federal investment credit (non-

passive activities) that is not attributable to Alaska property.

Under AS 43.20.021, Alaska adopts the Internal Revenue Code,

Sections 1–1399 and 6001–7872, with full force and effect,

unless excepted to or modified by provisions of Alaska law. In

Line 2b: Alaska does not allow credits for backup withholding,

credit for employer social security and Medicare taxes paid on

addition, AS 43.20.160 and AS 43.20.300 require the Department

to apply, as far as practicable, the administrative and judicial

certain employee tips, and other federal credits that are tax

interpretations of the federal income tax law.

reimbursements. See 15 AAC 20.145(f). Also note that Alaska

does not adopt Internal Revenue Code Sections 1400–1400U,

which may affect allowable federal-based credits.

Note that Alaska law does not adopt Internal Revenue Code

Sections 1400–1400U, which grant tax benefits for activities in

certain geographic zones, including those in “Enterprise Zones”

Line 4: Use Form 6395 to calculate general business credits

and “Gulf Opportunity Zones.” If the taxpayer qualifies for special

from a passive activity. Enter amount from Form 6395, line 20.

federal treatment under these code sections, this may require

that the taxpayer recompute some federal-based credits for

Line 9: Alaska allows unused federal-based credits to be carried

forward, based on applicable federal rules. An entry on line 9

Alaska purposes.

must be supported by a schedule, attached to the return, showing

the individual unused credits, by year generated and used, which

Other Related Forms

Form 6395 is used to account for passive activity limitations on

are available. The schedule must show credits on an as-if Alaska

basis, based on prior years’ Forms 6390 (or equivalent), not

an as-if Alaska basis.

federal credit carryover amounts.

If You Need Help

Alaska allows carryback of unused federal-based

If you have questions, need additional information or require

Line 10:

credits, based on applicable federal rules. An entry on line 10

other assistance, see our website at , or

must be supported by a schedule, attached to the return, showing

call:

the individual unused credits, by year generated and used, which

are available for carryback.

Juneau: 907-465-2320

Anchorage: 907-269-6620

Line 13a: Enter the Alaska alternative minimum tax (AMT) from

Schedule E, net of the Alaska credit for prior year minimum tax

In general, Form 6390 follows the function of federal Form

(AMT credit) from Schedule A, line 11. Alaska AMT is found on

3800, accounting for various groups of credits that require

Schedule E, line 3 (Form 6000 or 6100), line 1B (Form 6020), or

special treatment under the Internal Revenue Code.

Such

line 3C (Form 6150).

groups include “specified credits,” carryforward of “eligible small

business credits,” and passive/non-passive categories.

See

Lines 12b and 13b: Alaska incentive credits (from Form 6300)

federal instructions for federal Form 3800 for more details.

are applied first. Any Alaska regular or alternative minimum tax

(AMT), left after application of Alaska incentive credits, may be

From each of these baskets, Form 6390 removes any credits

offset by federal-based credits. Use the following worksheet to

that are not allowable for Alaska purposes. Alaska does not

determine the respective amounts of regular Alaska tax offset,

allow credits for backup withholding, credit for employer social

and AMT offset by Alaska incentive credits:

security and Medicare taxes paid on certain employee tips, and

other federal credits that are tax reimbursements. See 15 AAC

20.145(f).

0405-6390i Rev 01/02/2013 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2