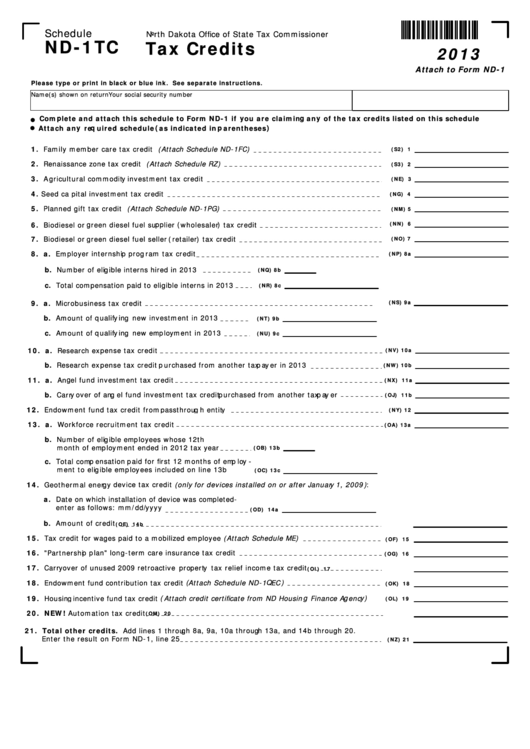

Schedule

North Dakota Office of State Tax Commissioner

ND-1TC

Tax Credits

2013

Attach to Form ND-1

Please type or print in black or blue ink. See separate instructions.

Name(s) shown on return

Your social security number

Complete and attach this schedule to Form ND-1 if you are claiming any of the tax credits listed on this schedule

Attach any required schedule (as indicated in parentheses)

1. Family member care tax credit (Attach Schedule ND-1FC)

(S2) 1

2. Renaissance zone tax credit (Attach Schedule RZ)

(S3) 2

3. Agricultural commodity investment tax credit

(NE) 3

4. Seed capital investment tax credit

(NG) 4

5. Planned gift tax credit (Attach Schedule ND-1PG)

(NM) 5

6. Biodiesel or green diesel fuel supplier (wholesaler) tax credit

(NN) 6

7. Biodiesel or green diesel fuel seller (retailer) tax credit

(NO) 7

8. a. Employer internship program tax credit

(NP) 8a

b. Number of eligible interns hired in 2013

(NQ) 8b

c. Total compensation paid to eligible interns in 2013

(NR) 8c

9. a. Microbusiness tax credit

(NS) 9a

b. Amount of qualifying new investment in 2013

(NT) 9b

c. Amount of qualifying new employment in 2013

(NU) 9c

10. a. Research expense tax credit

(NV) 10a

b. Research expense tax credit purchased from another taxpayer in 2013

(NW) 10b

11. a. Angel fund investment tax credit

(NX) 11a

b. Carryover of angel fund investment tax credit purchased from another taxpayer

(OJ) 11b

12. Endowment fund tax credit from passthrough entity

(NY) 12

13. a. Workforce recruitment tax credit

(OA) 13a

b. Number of eligible employees whose 12th

month of employment ended in 2012 tax year

(OB) 13b

c. Total compensation paid for first 12 months of employ-

ment to eligible employees included on line 13b

(OC) 13c

14. Geothermal energy device tax credit (only for devices installed on or after January 1, 2009):

a. Date on which installation of device was completed-

enter as follows: mm/dd/yyyy

(OD) 14a

b. Amount of credit

(OE) 14b

15. Tax credit for wages paid to a mobilized employee (Attach Schedule ME)

(OF) 15

16. "Partnership plan" long-term care insurance tax credit

(OG) 16

17. Carryover of unused 2009 retroactive property tax relief income tax credit

(OI) 17

18. Endowment fund contribution tax credit (Attach Schedule ND-1QEC)

(OK) 18

19. Housing incentive fund tax credit (Attach credit certificate from ND Housing Finance Agency)

(OL) 19

20. NEW! Automation tax credit

(OM) 20

21. Total other credits. Add lines 1 through 8a, 9a, 10a through 13a, and 14b through 20.

Enter the result on Form ND-1, line 25

(NZ) 21

1

1 2

2 3

3 4

4 5

5 6

6