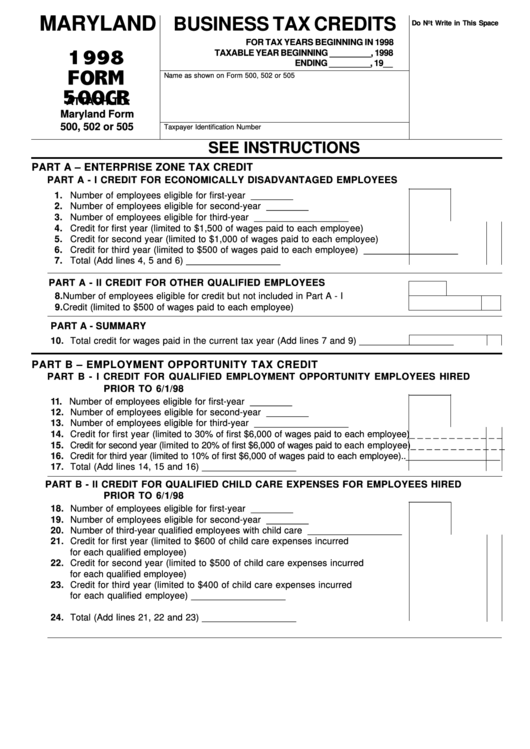

MARYLAND

BUSINESS TAX CREDITS

Do Not Write in This Space

FOR TAX YEARS BEGINNING IN 1998

TAXABLE YEAR BEGINNING _________, 1998

ENDING _________, 19__

Name as shown on Form 500, 502 or 505

ATTACH TO:

Maryland Form

500, 502 or 505

Taxpayer Identification Number

SEE INSTRUCTIONS

PART A – ENTERPRISE ZONE TAX CREDIT

PART A - I CREDIT FOR ECONOMICALLY DISADVANTAGED EMPLOYEES

________

1. Number of employees eligible for first-year credit..................................................... ________

2. Number of employees eligible for second-year credit............................................... ________

3. Number of employees eligible for third-year credit ................................................... __________________

4. Credit for first year (limited to $1,500 of wages paid to each employee)................. _ _ _ _ _ _ _ _ _ _ _ _

5. Credit for second year (limited to $1,000 of wages paid to each employee) ........... _ _ _ _ _ _ _ _ _ _ _ _

6. Credit for third year (limited to $500 of wages paid to each employee) .................. __________________

7. Total (Add lines 4, 5 and 6) ........................................................................................ __________________

PART A - II CREDIT FOR OTHER QUALIFIED EMPLOYEES

8. Number of employees eligible for credit but not included in Part A - I .....................

9. Credit (limited to $500 of wages paid to each employee) ........................................

PART A - SUMMARY

10. Total credit for wages paid in the current tax year (Add lines 7 and 9) .................... __________________

PART B – EMPLOYMENT OPPORTUNITY TAX CREDIT

PART B - I CREDIT FOR QUALIFIED EMPLOYMENT OPPORTUNITY EMPLOYEES HIRED

PRIOR TO 6/1/98

________

11. Number of employees eligible for first-year credit..................................................... ________

12. Number of employees eligible for second-year credit............................................... ________

13. Number of employees eligible for third-year credit ................................................... __________________

14. Credit for first year (limited to 30% of first $6,000 of wages paid to each employee) _ _ _ _ _ _ _ _ _ _ _ _

15. Credit for second year (limited to 20% of first $6,000 of wages paid to each employee) _ _ _ _ _ _ _ _ _ _ _ _

16. Credit for third year (limited to 10% of first $6,000 of wages paid to each employee) .. __________________

17. Total (Add lines 14, 15 and 16) ................................................................................. __________________

PART B - II CREDIT FOR QUALIFIED CHILD CARE EXPENSES FOR EMPLOYEES HIRED

PRIOR TO 6/1/98

________

18. Number of employees eligible for first-year credit..................................................... ________

19. Number of employees eligible for second-year credit............................................... ________

20. Number of third-year qualified employees with child care needs ............................. __________________

21. Credit for first year (limited to $600 of child care expenses incurred

for each qualified employee) ..................................................................................... _ _ _ _ _ _ _ _ _ _ _ _

22. Credit for second year (limited to $500 of child care expenses incurred

for each qualified employee) ..................................................................................... _ _ _ _ _ _ _ _ _ _ _ _

23. Credit for third year (limited to $400 of child care expenses incurred

for each qualified employee) ..................................................................................... __________________

24. Total (Add lines 21, 22 and 23) ................................................................................. __________________

1

1 2

2 3

3 4

4