Form Au-212 - New York State Pari-Mutuel Betting Tax Return

ADVERTISEMENT

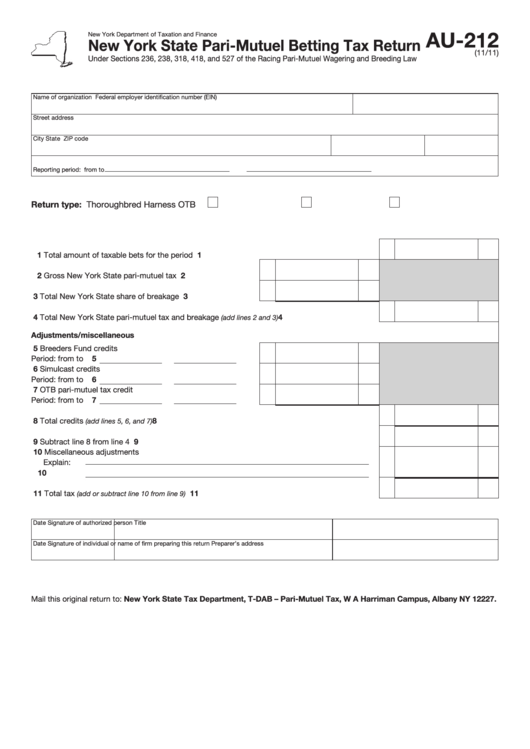

AU-212

New York Department of Taxation and Finance

New York State Pari-Mutuel Betting Tax Return

(11/11)

Under Sections 236, 238, 318, 418, and 527 of the Racing Pari-Mutuel Wagering and Breeding Law

Name of organization

Federal employer identification number (EIN)

Street address

City

State

ZIP code

Reporting period: from

to

Return type:

Thoroughbred

Harness

OTB

1 Total amount of taxable bets for the period ...................................................................................

1

2 Gross New York State pari-mutuel tax ....................................

2

3 Total New York State share of breakage .................................

3

4 Total New York State pari-mutuel tax and breakage

..........................................

4

(add lines 2 and 3)

Adjustments/miscellaneous

5 Breeders Fund credits

5

Period: from

to

.......

6 Simulcast credits

Period: from

to

.......

6

7 OTB pari-mutuel tax credit

Period: from

to

.......

7

8 Total credits

8

....................................................................................................

(add lines 5, 6, and 7)

9 Subtract line 8 from line 4 ..............................................................................................................

9

10 Miscellaneous adjustments

Explain:

10

11 Total tax

...................................................................................... 11

(add or subtract line 10 from line 9)

Date

Signature of authorized person

Title

Date

Signature of individual or name of firm preparing this return

Preparer’s address

Mail this original return to: New York State Tax Department, T-DAB – Pari-Mutuel Tax, W A Harriman Campus, Albany NY 12227.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2