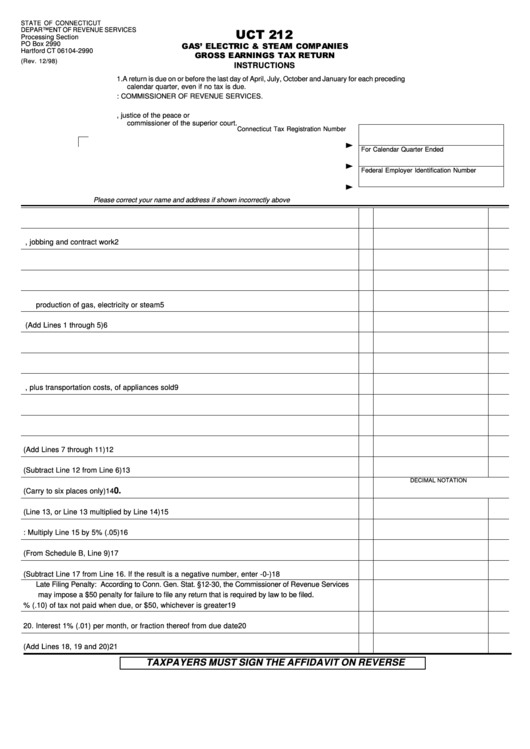

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

Processing Section

PO Box 2990

Hartford CT 06104-2990

(Rev. 12/98)

INSTRUCTIONS

1. A return is due on or before the last day of April, July, October and January for each preceding

calendar quarter, even if no tax is due.

2. Make check payable to: COMMISSIONER OF REVENUE SERVICES.

3. See line-by-line instructions enclosed.

4. The affidavit on the reverse side must be signed before a notary public, justice of the peace or

commissioner of the superior court.

Connecticut Tax Registration Number

For Calendar Quarter Ended

Federal Employer Identification Number

Please correct your name and address if shown incorrectly above

1. Income classified as operating revenues

1

2. Income from merchandising, jobbing and contract work

2

3. Income from non-utility operations

3

4. Revenues from leases of physical property not devoted to utility operation

4

5. Gross receipts from sale of residuals and other by-products obtained in connection with the

production of gas, electricity or steam

5

6. Total gross earnings (Add Lines 1 through 5)

6

7. Refunds resulting from error or overcharge

7

8. Gross earnings from sales for resale

8

9. Net invoice price, plus transportation costs, of appliances sold

9

10. Gross earnings from Energy Conservation Loan Programs

10

11. Income from sales of natural gas or propane as motor vehicle fuel

11

12. Total deductions (Add Lines 7 through 11)

12

13. Gross earnings less deductions (Subtract Line 12 from Line 6)

13

DECIMAL NOTATION

0.

14. Apportionment fraction (Carry to six places only)

14

15. Gross earnings subject to tax (Line 13, or Line 13 multiplied by Line 14)

15

16. Tax: Multiply Line 15 by 5% (.05)

16

17. Total Credits (From Schedule B, Line 9)

17

18. Tax due (Subtract Line 17 from Line 16. If the result is a negative number, enter -0-)

18

Late Filing Penalty: According to Conn. Gen. Stat. §12-30, the Commissioner of Revenue Services

may impose a $50 penalty for failure to file any return that is required by law to be filed.

19. Penalty 10% (.10) of tax not paid when due, or $50, whichever is greater

19

20. Interest 1% (.01) per month, or fraction thereof from due date

20

21. Amount due (Add Lines 18, 19 and 20)

21

TAXPAYERS MUST SIGN THE AFFIDAVIT ON REVERSE

1

1 2

2