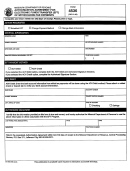

Instructions for Form EFT

Tax Type: Businesses may use electronic funds

•

Bank address: Indicate the address of the bank

transfers (EFT) to file and pay Maryland withholding,

branch you will be using.

sales and use, motor fuel and corporate income taxes.

•

Bank account number: The account number from

Accepted corporate forms are 500, 500D, 500DP and

which the state will draw debit entries.

500E only. Forms 510, 510D, 510E for Pass-Through

•

Type of account: Check the appropriate box for

Entities NOT accepted.

the type of account (savings or checking) you will

Section A – This section must be completed by

be using for electronic funds transfer.

ALL taxpayers.

•

Bank routing transit number: Your bank’s nine-

•

Business name - required

digit routing/transit number is required.

•

Maryland Central Registration Number - if

•

Signature

of

owner,

partner,

or

officer:

registered

Authorized signature of owner, partner or officer

•

Federal Employer Identification Number -

of the company. This signature will authorize the

required

Comptroller of Maryland to present debit entries.

•

Motor Fuel Tax Account Number - if applicable

Section C – Complete this section only if you are

choosing the ACH Credit option.

•

EFT contact person: The primary contact person

should be someone within your company who will be

Name and address of the bank: Provide the name

directly involved in all phases of the EFT registration

and address of the bank you will be using for electronic

process, system implementation, and the payment

fund transfers.

of the tax. Instructions will be mailed to the contact

Printed name and signature of bank representative

person designated on the agreement. You should

(include bank representative’s telephonenumber): You

also designate a secondary contact person.

cannot use the ACH Credit option unless your bank can

•

Address: Indicate the mailing address to be used

initiate transactions in this format.

for corresponding regarding electronic funds

Mail this completed form to:

transfer.

EFT Program

•

Telephone

number:

Indicate

the

telephone

P.O. Box 1509

number(s) for the EFT contact person.

Annapolis, MD 21404-1509

•

Signature

of

owner,

partner,

or

officer:

Authorized signature of owner, partner, or officer of

the company.

Section B – Complete this section only if you are

choosing the ACH Debit option.

•

Bank name: Name of the bank you will be using for

electronic funds transfers.

EFT Program telephone number 410-260-7980 • Fax: 410-260-6214

Hearing impaired users call via Maryland Relay at 711 in Maryland

COM/RAD-072 Rev. 10-10

1

1 2

2 3

3