Instructions For Form 200-02 Nr Non-Resident Individual Income Tax Return

ADVERTISEMENT

Form 200-02 NR

NON-RESIDENT INDIVIDUAL INCOME TAX RETURN

GENERAL INSTRUCTIONS

Who Must File

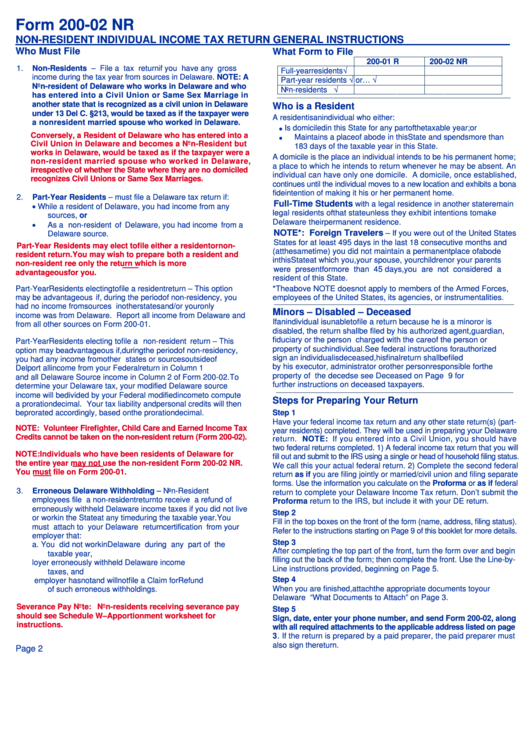

What Form to File

200-01 R

200-02 NR

1.

Non-Residents – File a tax return if you have any gross

√

Full-year residents

income during the tax year from sources in Delaware. NOTE: A

√ or…

√

Part-year residents

Non-resident of Delaware who works in Delaware and who

√

Non-residents

has entered into a Civil Union or Same Sex Marriage in

another state that is recognized as a civil union in Delaware

Who is a Resident

under 13 Del C. §213, would be taxed as if the taxpayer were

A resident is an individual who either:

a nonresident married spouse who worked in Delaware.

•

Is domiciled in this State for any part of the taxable year; or

Conversely, a Resident of Delaware who has entered into a

•

Maintains a place of abode in this State and spends more than

Civil Union in Delaware and becomes a Non-Resident but

183 days of the taxable year in this State.

works in Delaware, would be taxed as if the taxpayer were a

A domicile is the place an individual intends to be his permanent home;

non-resident married spouse who worked in Delaware,

a place to which he intends to return whenever he may be absent. An

irrespective of whether the State where they are no domiciled

individual can have only one domicile. A domicile, once established,

recognizes Civil Unions or Same Sex Marriages.

continues until the individual moves to a new location and exhibits a bona

fide intention of making it his or her permanent home.

2.

Part-Year Residents – must file a Delaware tax return if:

Full-Time Students

with a legal residence in another state remain

•

While a resident of Delaware, you had income from any

legal residents of that state unless they exhibit intentions to make

sources, or

Delaware their permanent residence.

•

As a non-resident of Delaware, you had income from a

NOTE*: Foreign Travelers

– If you were out of the United States

Delaware source.

States for at least 495 days in the last 18 consecutive months and

Part-Year Residents may elect to file either a resident or non-

(at the same time) you did not maintain a permanent place of abode

resident return. You may wish to prepare both a resident and

in this State at which you, your spouse, your children or your parents

non-resident return.

File only the return which is more

were present for more than 45 days, you are not considered a

advantageous for you.

resident of this State.

Part-Year Residents electing to file a resident return – This option

*The above NOTE does not apply to members of the Armed Forces,

may be advantageous if, during the period of non-residency, you

employees of the United States, its agencies, or instrumentalities.

had no income from sources in other states and/or your only

Minors – Disabled – Deceased

income was from Delaware. Report all income from Delaware and

If an individual is unable to file a return because he is a minor or is

from all other sources on Form 200-01.

disabled, the return shall be filed by his authorized agent, guardian,

fiduciary or the person charged with the care of the person or

Part-Year Residents electing to file a non-resident return – This

property of such individual. See federal instructions for authorized

option may be advantageous if, during the period of non-residency,

signature. If an individual is deceased, his final return shall be filed

you had any income from other states or sources outside of

by his executor, administrator or other person responsible for the

Delaware. Report all income from your Federal return in Column 1

property of the decedent. Please see Deceased on Page 9 for

and all Delaware Source income in Column 2 of Form 200-02. To

further instructions on deceased taxpayers.

determine your Delaware tax, your modified Delaware source

income will be divided by your Federal modified income to compute

Steps for Preparing Your Return

a proration decimal. Your tax liability and personal credits will then

be prorated accordingly, based on the proration decimal.

Step 1

Have your federal income tax retu rn and any other state return(s) (part-

NOTE: Volunteer Firefighter, Child Care and Earned Income Tax

year residents) completed. They will be used in preparing your Delaware

Credits cannot be taken on the non-resident return (Form 200-02).

return. NOTE: If you entered into a Civil Union, you should have

two federal returns completed. 1) A federal income tax return that you will

NOTE: Individuals who have been residents of Delaware for

fill out and submit to the IRS using a single or head of household filing status.

the entire year may not use the non-resident Form 200-02 NR.

We call this your actual federal return. 2) Complete the second federal

You must file on Form 200-01.

return as if you are filing jointly or married/civil union and filing separate

forms. Use the information you calculate on the Proforma or as if federal

3.

Erroneous

Delaware

Withholding

–

Non-Resident

return to complete your Delaware Income Tax return. Don’t submit the

employees file a non-resident return to receive a refund of

Proforma return to the IRS, but include it with your DE return.

erroneously withheld Delaware income taxes if you did not live

Step 2

or work in the State at any time during the taxable year. You

Fill in the top boxes on the front of the form (name, address, filing status).

must attach to your Delaware return certification from your

Refer to the instructions starting on Page 9 of this booklet for more details.

employer that:

Step 3

a.

You did not work in Delaware during any part of the

After completing the top part of the front, turn the form over and begin

taxable year,

filling out the back of the form; then complete the front. Use the Line-by-

b.

Your employer erroneously withheld Delaware income

Line instructions provided, beginning on Page 5.

taxes, and

Step 4

c.

Your employer has not and will not file a Claim for Refund

When you are finished, attach the appropriate documents to your

of such erroneous withholdings.

Delaware return. See “What Documents to Attach” on Page 3.

Severance Pay Note: Non-residents receiving severance pay

Step 5

should

see

Schedule

W–Apportionment

worksheet

for

Sign, date, enter your phone number, and send Form 200-02, along

instructions.

with all required attachments to the applicable address listed on page

3. If the return is prepared by a paid preparer, the paid preparer must

also sign the return.

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11