Your Name (as shown on page 1)

Your Social Security Number

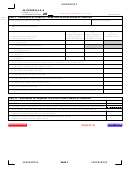

Schedule of Income Allocation

Complete this schedule only if you are an Arizona resident who is also considered to be a resident of another state under the laws of

that other state (dual resident); otherwise skip this schedule. See pages 2 and 8 of the instructions.

(a)

(b)

(c)

(d)

Amount entered

Amount entered in

in column (a)

column (c) that

Amount entered

reported on your

would be sourced to

Amount

in column (a)

2012 return filed

your statutory state of

reported on your

reported on your

to your statutory

residence as income of a

2012 federal return.

2012 Form 140.

state of residence.

nonresident of that state.

$

00 $

00 $

00 $

00

1

Wages, salaries, tips, etc. ...................

$

00 $

00 $

00 $

00

2

Interest................................................

$

00 $

00 $

00 $

00

3

Dividends ............................................

4

Business income or (loss) from

$

00 $

00 $

00 $

00

federal Schedule C .............................

5

Gains or (losses) from

$

00 $

00 $

00 $

00

federal Schedule D .............................

6

Rents, royalties, partnerships, estates,

trusts, small business corporations

$

00 $

00 $

00 $

00

from federal Schedule E .....................

7

Other income reported on

$

00 $

00 $

00 $

00

your federal return ..............................

$

00 $

00 $

00 $

00

8

Total Income: Add lines 1 through 7 ..

Other federal adjustments: List on

lines 9a through 9c:

$

00 $

00 $

00 $

00

9a

$

00 $

00 $

00 $

00

9b

$

00 $

00 $

00 $

00

9c

9d Total adjustments: Add lines 9a

$

00 $

00 $

00 $

00

through 9c for each column ................

10

Adjusted Gross Income: Subtract line

$

00 $

00 $

00 $

00

9d from line 8 for each column ...........

Print Schedule

ADOR 10136 (12)

AZ Form 309 (2012)

Page 2 of 2

1

1 2

2 3

3 4

4