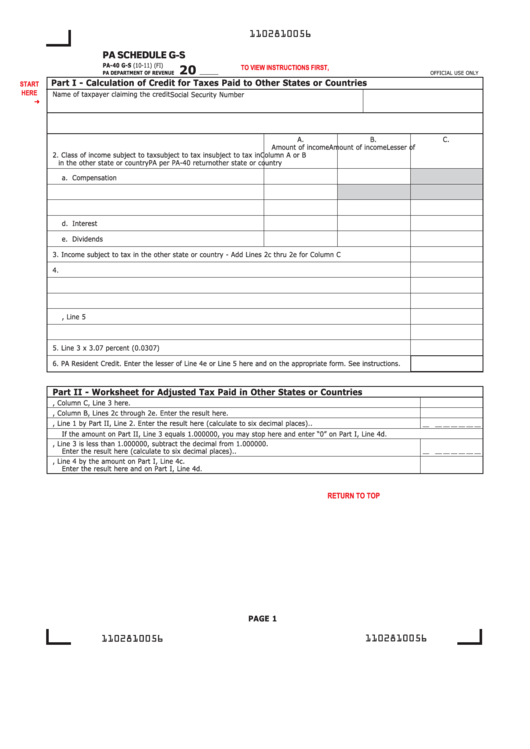

1102810056

PA SCHEDULE G-S

PA-40 G-S (10-11) (FI)

TO VIEW INSTRUCTIONS FIRST, CLICK HERE

20

PA DEPARTMENT OF REVENUE

OFFICIAL USE ONLY

Part I - Calculation of Credit for Taxes Paid to Other States or Countries

START

HERE

Name of taxpayer claiming the credit

Social Security Number

1. Name of other state or country

A.

B.

C.

Amount of income

Amount of income

Lesser of

2. Class of income subject to tax

subject to tax in

subject to tax in

Column A or B

in the other state or country

PA per PA-40 return other state or country

a. Compensation

b. Unreimbursed business expenses

c. Net compensation

d. Interest

e. Dividends

3. Income subject to tax in the other state or country - Add Lines 2c thru 2e for Column C

4. a. Tax due or assessed in other state or country

b. Tax paid in other state or country

c. Enter the lesser of Line 4a or Line 4b

d. Less adjustments - Enter the amount from Part II, Line 5

e. Adjusted tax paid in other state or country

5. Line 3 x 3.07 percent (0.0307)

6. PA Resident Credit. Enter the lesser of Line 4e or Line 5 here and on the appropriate form. See instructions.

Part II - Worksheet for Adjusted Tax Paid in Other States or Countries

1. Enter the amount from Part I, Column C, Line 3 here.

2. Add the amounts from Part I, Column B, Lines 2c through 2e. Enter the result here.

3. Divide the amount from Part II, Line 1 by Part II, Line 2. Enter the result here (calculate to six decimal places).

.

If the amount on Part II, Line 3 equals 1.000000, you may stop here and enter “0” on Part I, Line 4d.

4. If the amount on Part II, Line 3 is less than 1.000000, subtract the decimal from 1.000000.

Enter the result here (calculate to six decimal places).

.

5. Multiply the decimal on Part II, Line 4 by the amount on Part I, Line 4c.

Enter the result here and on Part I, Line 4d.

PRINT FORM

Reset Entire Form

RETURN TO TOP

PAGE 1

1102810056

1102810056

1

1 2

2 3

3 4

4