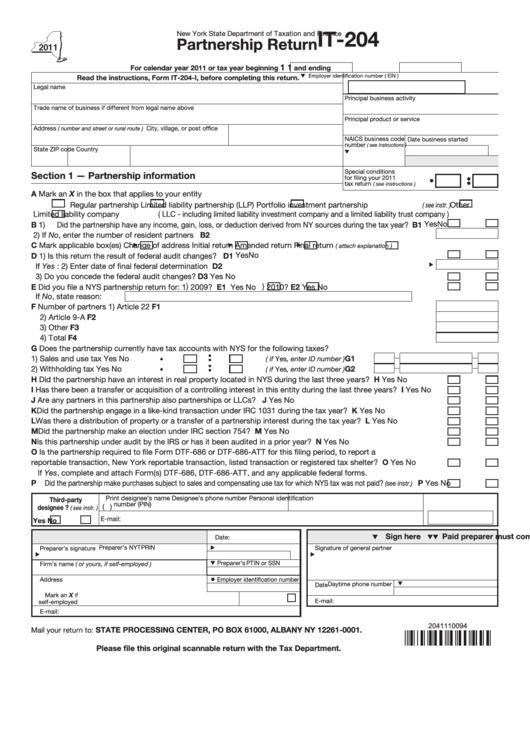

IT-204

New York State Department of Taxation and Finance

Partnership Return

1 1

For calendar year 2011 or tax year beginning

and ending

Employer identification number ( EIN )

Read the instructions, Form IT-204-I, before completing this return.

Legal name

Principal business activity

Trade name of business if different from legal name above

Principal product or service

Address

City, village, or post office

( number and street or rural route )

NAICS business code

Date business started

number

( see instructions )

State

ZIP code

Country

Special conditions

Section 1 — Partnership information

for filing your 2011

tax return

.......

( see instructions )

A

Mark an X in the box that applies to your entity

Regular partnership

Limited liability partnership (LLP)

Portfolio investment partnership

Other

( see instr. )

Limited liability company ( LLC - including limited liability investment company and a limited liability trust company )

1) Did the partnership have any income, gain, loss, or deduction derived from NY sources during the tax year? B1 Yes

No

B

2) If No, enter the number of resident partners ............................................................................................ B2

C Mark applicable box(es)

Change of address

Initial return

Amended return

Final return

( attach explanation )

1) Is this return the result of federal audit changes? ..................................................................................... D1 Yes

No

D

If Yes : 2) Enter date of final federal determination .............................................................................. D2

3) Do you concede the federal audit changes? ....................................................................... D3 Yes

No

Did you file a NYS partnership return for: 1 ) 2009? E1

.................... 2 ) 2010? E2 Yes

E

Yes

No

No

If No, state reason:

F

Number of partners

1) Article 22 ............................................................................................................... F1

2) Article 9-A .............................................................................................................. F2

3) Other ...................................................................................................................... F3

4) Total ....................................................................................................................... F4

G Does the partnership currently have tax accounts with NYS for the following taxes?

.... G1

1) Sales and use tax

Yes

No

........

( if Yes, enter ID number )

2) Withholding tax

Yes

No

........

.... G2

( if Yes, enter ID number )

H Did the partnership have an interest in real property located in NYS during the last three years? .................. H Yes

No

I

Has there been a transfer or acquisition of a controlling interest in this entity during the last three years? .... I Yes

No

J

Are any partners in this partnership also partnerships or LLCs? ..................................................................... J Yes

No

K

Did the partnership engage in a like-kind transaction under IRC 1031 during the tax year? ........................... K Yes

No

L

Was there a distribution of property or a transfer of a partnership interest during the tax year? ..................... L Yes

No

M Did the partnership make an election under IRC section 754? ........................................................................ M Yes

No

N Is this partnership under audit by the IRS or has it been audited in a prior year? ........................................... N Yes

No

O Is the partnership required to file Form DTF-686 or DTF-686-ATT for this filing period, to report a

reportable transaction, New York reportable transaction, listed transaction or registered tax shelter? ....... O Yes

No

If Yes, complete and attach Form(s) DTF-686, DTF-686-ATT, and any applicable federal forms.

P

Did the partnership make purchases subject to sales and compensating use tax for which NYS tax was not paid?

P Yes

No

(see instr.)

Print designee’s name

Designee’s phone number

Personal identification

Third-party

number (PIN)

(

)

designee ?

( see instr. )

E-mail:

Yes

No

Paid preparer must complete

Sign here

( see instr. )

Date:

Preparer’s NYTPRIN

Preparer’s signature

Signature of general partner

Preparer’s PTIN or SSN

Firm’s name ( or yours, if self-employed )

Address

Employer identification number

Daytime phone number

Date

Mark an X if

E-mail:

self-employed

E-mail:

2041110094

STATE PROCESSING CENTER, PO BOX 61000, ALBANY NY 12261-0001.

Mail your return to:

Please file this original scannable return with the Tax Department.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8