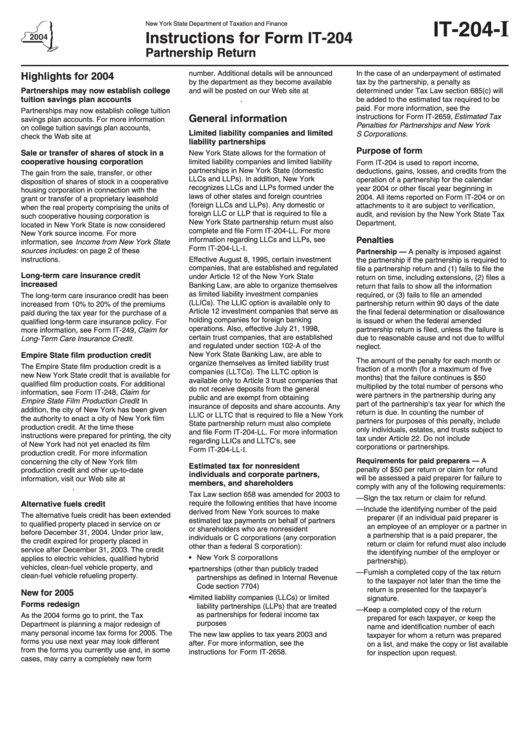

Instructions For Form It-204 - Partnership Return - New York State Department Of Taxation And Finance - 2004

ADVERTISEMENT

I

IT-204-

New York State Department of Taxation and Finance

Instructions for Form IT-204

Partnership Return

number. Additional details will be announced

In the case of an underpayment of estimated

Highlights for 2004

by the department as they become available

tax by the partnership, a penalty as

Partnerships may now establish college

and will be posted on our Web site at

determined under Tax Law section 685(c) will

tuition savings plan accounts

.

be added to the estimated tax required to be

paid. For more information, see the

Partnerships may now establish college tuition

instructions for Form IT-2659, Estimated Tax

General information

savings plan accounts. For more information

Penalties for Partnerships and New York

on college tuition savings plan accounts,

Limited liability companies and limited

S Corporations.

check the Web site at

liability partnerships

Purpose of form

Sale or transfer of shares of stock in a

New York State allows for the formation of

cooperative housing corporation

limited liability companies and limited liability

Form IT-204 is used to report income,

partnerships in New York State (domestic

deductions, gains, losses, and credits from the

The gain from the sale, transfer, or other

LLCs and LLPs). In addition, New York

operation of a partnership for the calendar

disposition of shares of stock in a cooperative

recognizes LLCs and LLPs formed under the

year 2004 or other fiscal year beginning in

housing corporation in connection with the

laws of other states and foreign countries

2004. All items reported on Form IT-204 or on

grant or transfer of a proprietary leasehold

(foreign LLCs and LLPs). Any domestic or

attachments to it are subject to verification,

when the real property comprising the units of

foreign LLC or LLP that is required to file a

audit, and revision by the New York State Tax

such cooperative housing corporation is

New York State partnership return must also

Department.

located in New York State is now considered

complete and file Form IT-204-LL . For more

New York source income. For more

information regarding LLCs and LLPs, see

Penalties

information, see Income from New York State

Form IT-204-LL-I.

sources includes: on page 2 of these

Partnership — A penalty is imposed against

instructions.

Effective August 8, 1995, certain investment

the partnership if the partnership is required to

companies, that are established and regulated

file a partnership return and (1) fails to file the

Long-term care insurance credit

under Article 12 of the New York State

return on time, including extensions, (2) files a

increased

Banking Law, are able to organize themselves

return that fails to show all the information

as limited liability investment companies

required, or (3) fails to file an amended

The long-term care insurance credit has been

(LLICs). The LLIC option is available only to

partnership return within 90 days of the date

increased from 10% to 20% of the premiums

Article 12 investment companies that serve as

the final federal determination or disallowance

paid during the tax year for the purchase of a

holding companies for foreign banking

is issued or when the federal amended

qualified long-term care insurance policy. For

operations. Also, effective July 21, 1998,

partnership return is filed, unless the failure is

more information, see Form IT-249, Claim for

certain trust companies, that are established

due to reasonable cause and not due to willful

Long-Term Care Insurance Credit.

and regulated under section 102-A of the

neglect.

Empire State film production credit

New York State Banking Law, are able to

The amount of the penalty for each month or

organize themselves as limited liability trust

The Empire State film production credit is a

fraction of a month (for a maximum of five

companies (LLTCs). The LLTC option is

new New York State credit that is available for

months) that the failure continues is $50

available only to Article 3 trust companies that

qualified film production costs. For additional

multiplied by the total number of persons who

do not receive deposits from the general

information, see Form IT-248, Claim for

were partners in the partnership during any

public and are exempt from obtaining

Empire State Film Production Credit . In

part of the partnership’s tax year for which the

insurance of deposits and share accounts. Any

addition, the city of New York has been given

return is due. In counting the number of

LLIC or LLTC that is required to file a New York

the authority to enact a city of New York film

partners for purposes of this penalty, include

State partnership return must also complete

production credit. At the time these

only individuals, estates, and trusts subject to

and file Form IT-204-LL. For more information

instructions were prepared for printing, the city

tax under Article 22. Do not include

regarding LLICs and LLTC’s, see

of New York had not yet enacted its film

corporations or partnerships.

Form IT-204-LL-I.

production credit. For more information

Requirements for paid preparers — A

concerning the city of New York film

Estimated tax for nonresident

penalty of $50 per return or claim for refund

production credit and other up-to-date

individuals and corporate partners,

will be assessed a paid preparer for failure to

information, visit our Web site at

members, and shareholders

comply with any of the following requirements:

.

Tax Law section 658 was amended for 2003 to

— Sign the tax return or claim for refund.

require the following entities that have income

Alternative fuels credit

— Include the identifying number of the paid

derived from New York sources to make

The alternative fuels credit has been extended

preparer (if an individual paid preparer is

estimated tax payments on behalf of partners

to qualified property placed in service on or

an employee of an employer or a partner in

or shareholders who are nonresident

before December 31, 2004. Under prior law,

a partnership that is a paid preparer, the

individuals or C corporations (any corporation

the credit expired for property placed in

return or claim for refund must also include

other than a federal S corporation):

service after December 31, 2003. The credit

the identifying number of the employer or

• New York S corporations

applies to electric vehicles, qualified hybrid

partnership).

vehicles, clean-fuel vehicle property, and

• partnerships (other than publicly traded

— Furnish a completed copy of the tax return

clean-fuel vehicle refueling property.

partnerships as defined in Internal Revenue

to the taxpayer not later than the time the

Code section 7704)

return is presented for the taxpayer’s

New for 2005

• limited liability companies (LLCs) or limited

signature.

Forms redesign

liability partnerships (LLPs) that are treated

— Keep a completed copy of the return

as partnerships for federal income tax

As the 2004 forms go to print, the Tax

prepared for each taxpayer, or keep the

purposes

Department is planning a major redesign of

name and identification number of each

many personal income tax forms for 2005. The

The new law applies to tax years 2003 and

taxpayer for whom a return was prepared

forms you use next year may look different

after. For more information, see the

on a list, and make the copy or list available

from the forms you currently use and, in some

instructions for Form IT-2658.

for inspection upon request.

cases, may carry a completely new form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12