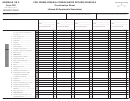

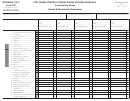

Schedule Cr (Form 720) - Pro Forma Federal Consolidated Return Schedule Page 2

ADVERTISEMENT

41A720CR (10-13)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

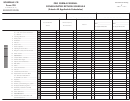

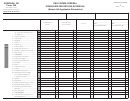

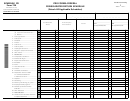

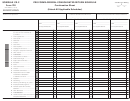

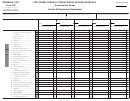

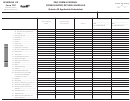

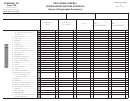

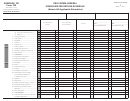

Schedule CR—Pro Forma Federal Consolidated Return Schedule and

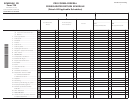

Schedule CR–C—Pro Forma Federal Consolidated Return Schedule–Continuation Sheet

GENERAL INSTRUCTIONS

Purpose of Schedule—This schedule must be completed to compute the federal consolidated net income of an affiliated group filing

a mandatory nexus consolidated Kentucky tax return as provided by KRS 141.200(11). Schedule CR and, if applicable, Schedule(s)

CR-C must be attached to Form 720, Kentucky Corporation Income Tax and LLET Return, filed with the Kentucky Department of

Revenue.

Specific Instructions—For each subsidiary, enter the name, federal employer identification number (FEIN) and Kentucky Corporation/

LLET Account Number. If there are more than two subsidiaries in the affiliated group, use Schedule CR-C, Pro Forma Federal

Consolidated Return Schedule Continuation Sheet.

Lines 1–10—Enter the items of federal income for the parent and each subsidiary using the instructions for Form 1120, U.S. Corporation

Income Tax Return, Lines 1 through 10. Enter for each line the intercompany elimination in the Intercompany Eliminations column

and the consolidated total in the Consolidated Totals column.

Line 11—Enter the total of Lines 1 through 10 in each column.

Lines 12–26—Enter the federal deductions for the parent and each subsidiary using the instructions for Form 1120, U.S. Corporation

Income Tax Return, Lines 12 through 26. Enter for each line the intercompany elimination in the Intercompany Eliminations column

and the consolidated total in the Consolidated Totals column.

Line 27—Enter the total of Lines 12 through 26 for each column.

Line 28—Enter the amount of Line 11 less Line 27 for each column.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2