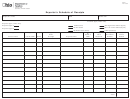

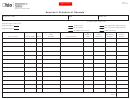

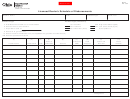

MF 2-2

Rev. 11/08

Instructions for Licensed Dealer’s Schedule of Disbursements

Page 2

This schedule provides detail in support of the amount(s) shown as disbursements

Schedule 10 (SCHEDULE 10 DOES NOT PERTAIN TO GASOLINE OR CLEAR

on the licensed dealer’s reconciliation reports. Insert in the appropriate box your

DIESEL.) For customers purchasing less than 800 nontaxable

company name, FEIN and month/year (use MM/YYYY format) of the report.

gallons in a month, a lump sum total amount of all such sales must

be provided. Individual detail must be maintained to substantiate

Each disbursement of fuel must be listed on a separate line (see special

this lump sum amount. For customers purchasing more than 800

instructions, below). LIKE PURCHASERS MUST BE GROUPED TOGETHER,

nontaxable gallons in a month a valid FEIN and a total of gross

AND A GALLONAGE SUBTOTAL BY LIKE FEIN MUST BE PROVIDED.

gallons sold is required to be provided, broken down by each

individual customer.

Schedule Type

Stationary Transfer. Transfer of ownership of reportable product from one dealer

A separate schedule is REQUIRED to be completed for each schedule type.

to another dealer within a bulk plant must be reported. If ownership of product

Insert the schedule type number (from the face of the schedule) in the appropriate

is transferred by you within a bulk plant, you must report Schedule 6 on the

box.

disbursements schedule. List the mode of transport as ST.

Product Type

Book Adjustment. Transfers within a bulk plant from one product to another must

be accounted for on the disbursements schedule. Book adjustments can only

A separate schedule is REQUIRED to be completed

be listed on Schedule 2 (for the receipt) and Schedule 6 (for the disbursement).

for each individual product type.

List on Schedule 6 where the product is being transferred to; list on Schedule 2

On the face of the schedule, place a mark next to the product type being reported

where the product is being transferred from. FEINs do not need to be provided

on the schedule. IMPORTANT – All No. 1 distillate products that are “dyed,”

in column 7 for book adjustment transactions. List the mode of transport as BA.

regardless of their name, are to be reported under product code No. 226 (high

sulfur diesel – dyed) or No. 227 (low sulfur diesel – dyed). All No. 1 distillate

Column Instructions

products that are “undyed” (this includes AVJET fuel), regardless of their name,

Column 1

Enter the name of the company that transports the fuel.

are to be reported under product code 142 (kerosene).

Column 2

Enter the FEIN of the company that transports the fuel.

Special Instructions

Column 3

Enter the mode of transport. Use one of the following letters:

Schedule 5

For diesel fuel sales to customers purchasing less than 800 taxable

J=Truck; R=Rail; B=Barge; P=Pipeline; S=Ship; ST=Stationary

gallons in a month, please provide a lump sum total amount of such

Transfer; BA=Book Adjustment

sales. For diesel fuel sales to customers purchasing more than

800 taxable gallons in a month, gallonage is required to be broken

Column 4

Enter the two-letter state abbreviation to where the fuel was

down, grouped and totaled by like individual customer FEIN.

transported. If fuel is transported to a terminal, use the uniform

terminal code.

For gasoline sales to customers, other than retail service stations,

please provide a lump sum total amount of such sales. For gasoline

Column 6

Enter fuel purchaser’s name. If you used the fuel yourself, insert

sales to retail service stations, gallonage is required to be broken

your own name.

down, grouped and totaled by like individual customer FEIN.

Column 7

Enter the purchaser’s FEIN. This is REQUIRED in ALL instances

except book adjustments.

Schedule 6

Include on this schedule sales to licensed motor fuel dealers,

exporter type A and B, book adjustments and distributions made

Column 8

Enter the date the fuel was shipped (use mm/dd/yy format).

to terminals. Gallonage is required to be broken down, grouped

and subtotaled by like purchaser FEIN.

Column 9

Enter the document number identifying the fuel. In the case of fuel

disbursed from a terminal, use the bill of lading (shipping document)

Schedule 7

A separate and subtotaled schedule must be completed for

number. For fuel disbursed from a bulk plant, use the invoice number.

each state of exportation.

Column 11

Enter the gross gallons disbursed.

1

1 2

2