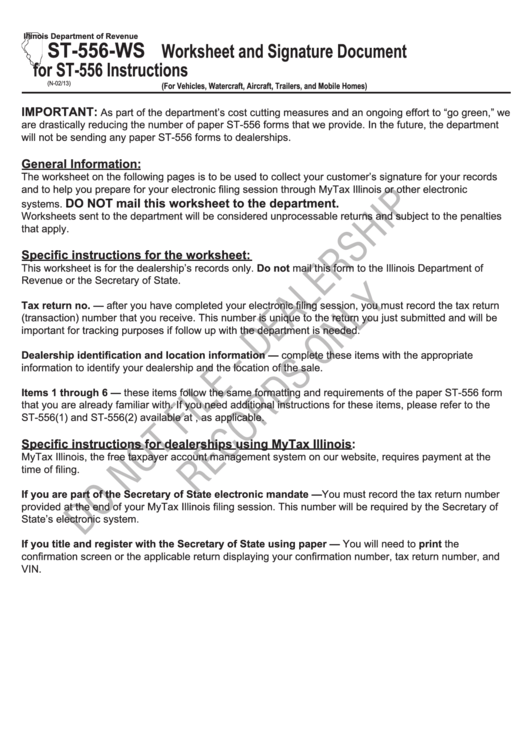

Illinois Department of Revenue

ST‑556‑WS

Worksheet and Signature Document

for ST‑556 Instructions

(N-02/13)

(For Vehicles, Watercraft, Aircraft, Trailers, and Mobile Homes)

IMPORTANT:

As part of the department’s cost cutting measures and an ongoing effort to “go green,” we

are drastically reducing the number of paper ST-556 forms that we provide. In the future, the department

will not be sending any paper ST-556 forms to dealerships.

General Information:

The worksheet on the following pages is to be used to collect your customer’s signature for your records

and to help you prepare for your electronic filing session through MyTax Illinois or other electronic

DO NOT mail this worksheet to the department.

systems.

Worksheets sent to the department will be considered unprocessable returns and subject to the penalties

that apply.

Specific instructions for the worksheet:

This worksheet is for the dealership’s records only. Do not mail this form to the Illinois Department of

Revenue or the Secretary of State.

Tax return no. — after you have completed your electronic filing session, you must record the tax return

(transaction) number that you receive. This number is unique to the return you just submitted and will be

important for tracking purposes if follow up with the department is needed.

Dealership identification and location information — complete these items with the appropriate

information to identify your dealership and the location of the sale.

Items 1 through 6 — these items follow the same formatting and requirements of the paper ST-556 form

that you are already familiar with. If you need additional instructions for these items, please refer to the

ST-556(1) and ST-556(2) available at tax.illinois.gov, as applicable.

Specific instructions for dealerships using MyTax Illinois:

MyTax Illinois, the free taxpayer account management system on our website, requires payment at the

time of filing.

If you are part of the Secretary of State electronic mandate —You must record the tax return number

provided at the end of your MyTax Illinois filing session. This number will be required by the Secretary of

State’s electronic system.

If you title and register with the Secretary of State using paper — You will need to print the

confirmation screen or the applicable return displaying your confirmation number, tax return number, and

VIN.

1

1 2

2 3

3