ST AR

Rev. 8/13

Sales and Use Tax Division

P.O. Box 530

Columbus, OH 43216-0530

tax.ohio.gov

Instructions for Filling Out the Application for Sales/Use Tax Refund

THE ORIGINAL AND ONE COPY OF OHIO FORM ST AR MUST BE FILED.

Only one set of back-up documents is needed.

Note: Incomplete applications will not be accepted for fi ling or considered for a refund. The department will return the

application, documents and supporting schedules to the applicant without processing if questions 1 through 9 are not fully

answered and page 4 of the application or an electronic spreadsheet set up like the example on page 4 listing every invoice

included in the refund application is not provided. Refund applicants may reapply for a refund after completing the application.

In order to be considered for a refund, all refund applications must be accepted for fi ling by the department within four years

from the date of the illegal or erroneous payment of the tax.

1. Lines 1 through 9 on the front of this application must be

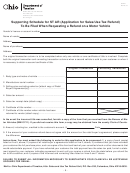

6. Vendor-fi led claims: “Vendor” means the person providing

completed. Please type or print in ink.

the service or by whom the transfer effected or license given

by a sale is or is to be made. The following information

2. The application will not be accepted if more than one line

must be supplied for vendor-fi led applications (refer to

is entered under line 6.

page 7 for a complete checklist):

a) Copies of invoices or similar documents for which a

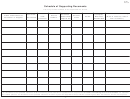

3. Page 4 must be completed for all consumer- and vendor-

refund is being sought.

fi led claims. If the claim is for tax paid to the Clerk of

b) If the tax was collected from a consumer, proof (e.g.,

Courts, then page 5 must also be completed. If the claim

cancelled checks) that the applicant has reimbursed

contains 25 or more invoices, a spreadsheet set up like

the consumer for the amount of the refund claimed.

the example on page 4 must be provided on electronic

c) The reason why the payment of the tax was illegal

media.

or erroneous. If you were not provided with a fully

completed exemption certifi cate prior to or at the time

4. THE ORIGINAL AND ONE COPY OF OHIO FORM ST AR

of sale, your customer must prepare, and you must

MUST BE FILED. Only one set of back-up documents

attach to this refund claim, a detailed description of

is needed. Please make a copy of the application for your

how the item sold was used. References to the Ohio

records. Mail to:

Revised Code or legal opinions alone are insuffi cient

for purposes of this claim and will delay the processing

Ohio Department of Taxation

of this application.

Attn: Sales and Use Tax Refund Unit

d) A spreadsheet set up like the example on page 4 listing

P.O. Box 530

every invoice included on the application for refund. If

Columbus, OH 43216-0530

the claim contains 25 or more invoices, a spreadsheet

888-405-4039

set up like the example on page 4 must be provided on

5. Consumer-fi led claims: “Consumer” means the person

electronic media.

for whom the service is provided, to whom the transfer

7. This application must be fi led in accordance with R.C.

effected or license given by a sale is or is to be made

sections 5739.07 and 5741.10 and must be fi led within

or given, or to whom the admission is granted. The

four years from the date of the erroneous payment of the

following information must be supplied for consumer-fi led

tax. If you choose to have someone else represent you

applications (refer to page 6 for a complete checklist):

for this refund, you must complete section 8 on the front

a) Copies of invoices or similar documents for which a

of the application or submit a power of attorney or Ohio

refund is being sought.

form TBOR 1 (Declaration of Tax Representative).

b) Proof of payment of the tax (e.g., cancelled checks) if

the consumer paid the tax either to the vendor, seller

8. When a refund is granted under R.C. section 5739.07 or

or directly to the state.

5741.10, it shall include interest thereon as provided by

c) The reason why the payment of the tax was illegal or

R.C. section 5739.132.

erroneous. You must give a detailed description of how

the subject item you purchased was used. References

9. In the event that any person/entity entitled to a refund

to the Ohio Revised Code (R.C.) or legal opinions alone

is indebted to the state of Ohio, the amount of such

are insuffi cient for purposes of this claim and will delay

indebtedness that is due and payable shall be certifi ed

the processing of this application.

to the auditor of state by the tax commissioner, along

d) A spreadsheet set up like the example on page 4 listing

with their determination upon the application for refund. A

every invoice included on the application for refund. If

warrant, up to the amount of any indebtedness, shall be

the claim contains 25 or more invoices, a spreadsheet

drawn payable to the Ohio Treasurer of State in satisfaction

set up like the example on page 4 must be provided on

of the amount due the state as authorized in R.C. sections

electronic media.

5739.072 and 5741.101. Any excess of such indebtedness

shall be drawn payable to the applicant.

- 1 -

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9