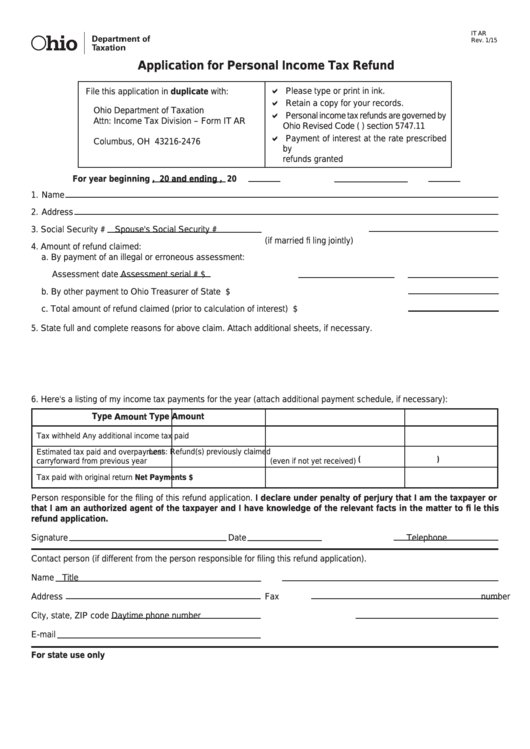

IT AR

Rev. 1/15

Reset Form

Application for Personal Income Tax Refund

Please type or print in ink.

File this application in duplicate with:

Retain a copy for your records.

Ohio Department of Taxation

Personal income tax refunds are governed by

Attn: Income Tax Division – Form IT AR

Ohio Revised Code (R.C.) section 5747.11

P.O. Box 2476

Payment of interest at the rate prescribed

Columbus, OH 43216-2476

by R.C. section 5703.47 is issued on all

refunds granted

For year beginning

, 20

and ending

, 20

1. Name

2. Address

3. Social Security #

Spouse's Social Security #

(if married fi ling jointly)

4. Amount of refund claimed:

a. By payment of an illegal or erroneous assessment:

Assessment date

Assessment serial #

$

b. By other payment to Ohio Treasurer of State .........................................................................$

c. Total amount of refund claimed (prior to calculation of interest) .............................................$

5. State full and complete reasons for above claim. Attach additional sheets, if necessary.

6. Here's a listing of my income tax payments for the year (attach additional payment schedule, if necessary):

Type

Type

Amount

Amount

Tax withheld

Any additional income tax paid

Estimated tax paid and overpayment

Less: Refund(s) previously claimed

(

)

carryforward from previous year

(even if not yet received)

Tax paid with original return

Net Payments

$

Person responsible for the filing of this refund application. I declare under penalty of perjury that I am the taxpayer or

that I am an authorized agent of the taxpayer and I have knowledge of the relevant facts in the matter to fi le this

refund application.

Signature

Date

Telephone number

Contact person (if different from the person responsible for filing this refund application).

Name

Title

Address

Fax number

City, state, ZIP code

Daytime phone number

E-mail

For state use only

1

1