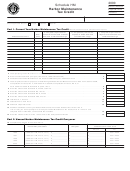

23 Complete only if line 4 is more than line 21.

arryover to Future Years

Subtract col. b from col. a

c. Unused credit available

Amount

For

a. Unused credits from prior years

b. Portion used

Year

and current year credit

this year

2009

(2012 Sch. HM, line 22, col. c) __________________

_________________

_________________

2014

2010

(2012 Sch. HM, line 22, col. c) __________________

_________________

_________________

2014–2015

2011

(2012 Sch. HM, line 22, col. c) __________________

_________________

_________________

2014–2016

2012

(2012 Sch. HM, line 22, col. c) __________________

_________________

_________________

2014–2017

2013

(2013 Sch. HM, line 2)

__________________

_________________

_________________

2014–2018

__________________

_________________

_________________

24

Totals

“Containerized cargo,” shall mean general goods, commodities

or wares that are shipped in non-disposable, reusable, commer-

Massachusetts General Laws, Chapter 63, section 38P provides

General Information

cial sized shipping containers that are customarily used on sea-

for a credit against the corporate excise for certain harbor main-

and ocean-going vessels for the convenient shipment of such

tenance taxes paid to the U.S. Customs Service pursuant to IRC

goods, commodities or wares.

Sections 4461 and 4462. A corporation is eligible for the credit

for harbor maintenance taxes paid on or after July 1, 1996, if the

Taxes paid with respect to passengers, the shipment of bulk cargo

tax paid is attributable to the shipment of break-bulk or con -

or the shipment of any other cargo or item of commerce not in-

tainerized cargo by sea- and ocean-going vessels through Mass -

cluded in the meaning of break-bulk or containerized cargo are

achusetts ports.

not eligible for this credit.

“Break-bulk cargo,” shall mean general goods, commodities or

The credit is not subject to the 50% limitations of MGL Ch. 63,

wares which are customarily shipped in boxed, bagged, crated

sec. 32C, however, it may not reduce the corporate excise to less

or unitized form, held in the vessel’s general holding areas, and

than the minimum excise of $456. A taxpayer may carryover any

handled by the piece, unit or in separate lots; without limiting the

excess credit to any of the next succeeding five taxable years.

generality of the foregoing definition of break-bulk cargo, that

Documentation must be provided by the taxpayer, upon request

term shall include road motor vehicles and other odd-size cargo,

by the Department, that the taxpayer claiming the Credit has paid

but shall not include containerized cargo or bulk cargo.

the Harbor Maintenance Tax. Such documentation may include,

“Bulk cargo,” shall mean unsegregated mass commodities in-

but is not limited to, U.S. Customs Form 349 and/or Customs

cluding, without limitation, items such as petroleum products,

Form 7501.

coal and bulk salt which are carried loose and which are custom -

arily loaded and unloaded by pumping, shoveling, scooping or

other similar means.

1

1 2

2