Form Et-415 - Application For Deferred Payment Of Estate Tax

ADVERTISEMENT

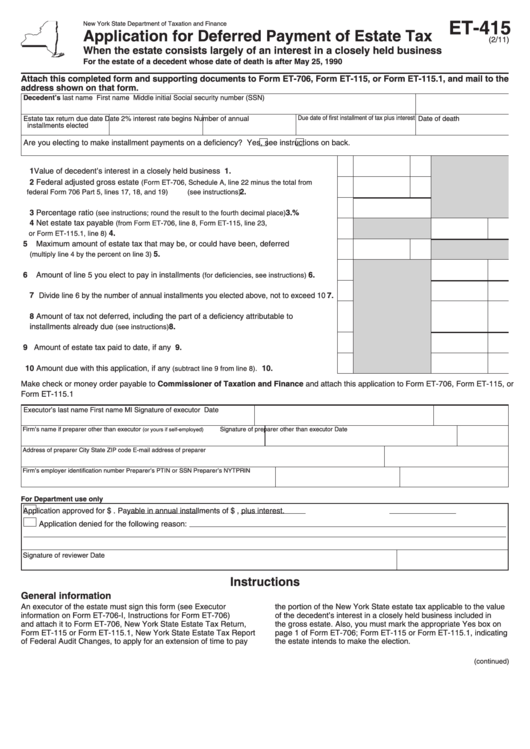

ET-415

New York State Department of Taxation and Finance

Application for Deferred Payment of Estate Tax

(2/11)

When the estate consists largely of an interest in a closely held business

For the estate of a decedent whose date of death is after May 25, 1990

Attach this completed form and supporting documents to Form ET-706, Form ET-115, or Form ET-115.1, and mail to the

address shown on that form.

Decedent’s last name

First name

Middle initial

Social security number (SSN)

Estate tax return due date

Date 2% interest rate begins Number of annual

Due date of first installment of tax plus interest

Date of death

installments elected

Are you electing to make installment payments on a deficiency? ......

Yes

No ........ If Yes, see instructions on back.

1 Value of decedent’s interest in a closely held business ..................................................

1.

2 Federal adjusted gross estate

(Form ET-706, Schedule A, line 22 minus the total from

.............................................

2.

federal Form 706 Part 5, lines 17, 18, and 19) (see instructions)

3 Percentage ratio

3.

%

......................

(see instructions; round the result to the fourth decimal place)

4 Net estate tax payable

(from Form ET-706, line 8, Form ET-115, line 23,

.................................................................................................

4.

or Form ET-115.1, line 8)

5 Maximum amount of estate tax that may be, or could have been, deferred

.............................................................................

5.

(multiply line 4 by the percent on line 3)

6 Amount of line 5 you elect to pay in installments

6.

............

(for deficiencies, see instructions)

7 Divide line 6 by the number of annual installments you elected above, not to exceed 10 ....

7.

8 Amount of tax not deferred, including the part of a deficiency attributable to

8.

installments already due

....................................................................

(see instructions)

9 Amount of estate tax paid to date, if any .........................................................................

9.

10 Amount due with this application, if any

. .................................. 10.

(subtract line 9 from line 8)

Make check or money order payable to Commissioner of Taxation and Finance and attach this application to Form ET-706, Form ET-115, or

Form ET-115.1

Executor’s last name

First name

MI

Signature of executor

Date

Firm’s name if preparer other than executor

Signature of preparer other than executor

Date

(or yours if self-employed)

Address of preparer

City

State

ZIP code

E-mail address of preparer

Firm’s employer identification number

Preparer’s PTIN or SSN

Preparer’s NYTPRIN

For Department use only

Application approved for $

. Payable in

annual installments of $

, plus interest.

Application denied for the following reason:

Signature of reviewer

Date

Instructions

General information

An executor of the estate must sign this form (see Executor

the portion of the New York State estate tax applicable to the value

information on Form ET-706-I, Instructions for Form ET-706)

of the decedent’s interest in a closely held business included in

and attach it to Form ET-706, New York State Estate Tax Return,

the gross estate. Also, you must mark the appropriate Yes box on

Form ET-115 or Form ET-115.1, New York State Estate Tax Report

page 1 of Form ET-706; Form ET-115 or Form ET-115.1, indicating

of Federal Audit Changes, to apply for an extension of time to pay

the estate intends to make the election.

(continued)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3