Form Gt-456 - Gasoline Tax Return

Download a blank fillable Form Gt-456 - Gasoline Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Gt-456 - Gasoline Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

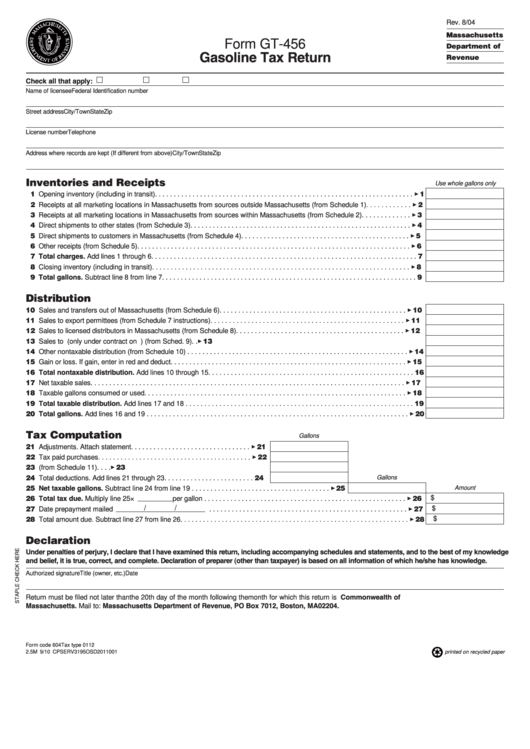

Rev. 8/04

Massachusetts

Form GT-456

Department of

Gasoline Tax Return

Revenue

Check all that apply:

Distributor

Importer

Exporter. For the month of

Name of licensee

Federal Identification number

Street address

City/Town

State

Zip

License number

Telephone

Address where records are kept (If different from above)

City/Town

State

Zip

Inventories and Receipts

Use whole gallons only

11 Opening inventory (including in transit). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 1

12 Receipts at all marketing locations in Massachusetts from sources outside Massachusetts (from Schedule 1) . . . . . . . . . . . . 3 2

13 Receipts at all marketing locations in Massachusetts from sources within Massachusetts (from Schedule 2) . . . . . . . . . . . . . 3 3

14 Direct shipments to other states (from Schedule 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4

15 Direct shipments to customers in Massachusetts (from Schedule 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 5

16 Other receipts (from Schedule 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 6

17 Total charges. Add lines 1 through 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Closing inventory (including in transit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 8

19 Total gallons. Subtract line 8 from line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Distribution

10 Sales and transfers out of Massachusetts (from Schedule 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 10

11 Sales to export permittees (from Schedule 7 instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 11

12 Sales to licensed distributors in Massachusetts (from Schedule 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 12

13 Sales to U.S. government (only under contract on U.S. Forms 32 and 33 or authorized purchase orders) (from Sched. 9). . 3 13

14 Other nontaxable distribution (from Schedule 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 14

15 Gain or loss. If gain, enter in red and deduct . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 15

16 Total nontaxable distribution. Add lines 10 through 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Net taxable sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 17

18 Taxable gallons consumed or used . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 18

19 Total taxable distribution. Add lines 17 and 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Total gallons. Add lines 16 and 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 20

Tax Computation

Gallons

21 Adjustments. Attach statement. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 21

22 Tax paid purchases. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

23 U.S. government and foreign consulate sales (from Schedule 11) . . . . 3 23

24 Total deductions. Add lines 21 through 23 . . . . . . . . . . . . . . . . . . . . . . . . 24

Gallons

Amount

25 Net taxable gallons. Subtract line 24 from line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 325

26 Total tax due. Multiply line 25 ×

$

per gallon . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 26

/

/

$

27 Date prepayment mailed

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 27

$

28 Total amount due. Subtract line 27 from line 26. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 28

Declaration

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which he/she has knowledge.

Authorized signature

Title (owner, etc.)

Date

Return must be filed not later than the 20th day of the month following the month for which this return is made. Make check payable to the Commonwealth of

Massachusetts. Mail to: Massachusetts Department of Revenue, PO Box 7012, Boston, MA 02204.

Form code 604 Tax type 0112

2.5M 9/10 CPSERV3195OSD2011001

printed on recycled paper

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2