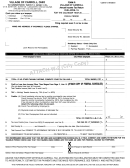

Form Gt-456 - Gasoline Tax Return Page 2

Download a blank fillable Form Gt-456 - Gasoline Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Gt-456 - Gasoline Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Form GT-456 Instructions

General Instructions

5, indicating gallons acquired and their source. An example of “other

receipts” would be returns from retail accounts.

Taxpayers must file a return for each calendar month by the 20th day

of the following month. A return must be filed even if no tax is due.

Line 8. Closing inventory. See instructions for line 1.

When entering license information, add prefix to indicate type of

Distribution

license.

Line 10. Sales and transfers out of Massachusetts. Enter the total

gallonage of all gasoline shipped out of this state from refineries,

Make check or money order payable to Commonwealth of Mass-

vendors or marketing locations to other states via the reporting com-

achusetts. Mail return and schedules, with check or money order,

pany’s own vehicles or those of a common carrier. For each product

to: Massachusetts Department of Revenue, PO Box 7012, Bos-

code, you must complete a separate Form MF-D, Schedule 6, indi-

ton, MA 02204. Taxpayers with annual liabilities of $10,000 or more

cating gallons sold to each customer.

must remit tax electronically. Go to to register

for WebFile for Business.

Line 11. Sales to export permittees. Enter the total gallons sold

(without tax) to licensed exporters for direct shipment by them to

Rounding gallons. On your return, you must round off fractions of

other states. For each product code, you must complete a separate

a gallon to the nearest whole gallon. Round down to the next lowest

Form MF-D, Schedule 7, indicating gallons sold to each customer.

whole gallon all fractions of a gallon less than a half-gallon. Round

up to the next highest whole gallon all fractions of a gallon of a half-

Line 12. Sales to licensed distributors in Massachusetts. Enter

gallon or more.

all tax-free sales to other licensed distributors in this state. For each

product code, you must complete a separate Form MF-D, Schedule

Line Instructions

8, indicating gallons sold to each customer.

Inventories and Receipts

Line 1. Opening inventory. The opening inventory is to be the

Line 13. Sales to U.S. Government under contract. Enter total

same as that reported as “inventory at end of month” on the previous

non-taxable sales made in Massachusetts to the United States Gov-

month’s return. Enter one composite figure covering all gasoline

ernment under contract. For each product code, you must complete

products on hand at all marketing locations in the state, including

a separate Form MF-D, Schedule 9, indicating gallons sold to each

terminals and pipe lines and is to include all vessel, wagon or tank

agency of the U.S. Government.

car shipments that were in transit and not yet received at these loca-

Line 14. Other non-taxable distribution. Enter all non-taxable

tions as at the close of the month.

items not shown in lines 10 through13. Unusual losses such as fire,

Line 2. Receipts at all marketing locations in Massachusetts

flood, collision, etc., should be included in this line and explained with

from sources outside Massachusetts. Enter the total of all receipts

supporting documentation. Also on this line should be included all

at all marketing locations in this state from all sources outside this

bulk sales to tax-exempt entities such as the Massachusetts Water

state. For each product code, you must complete a separate Form

Resources Authority, Massachusetts Port Authority, MBTA and Tran-

MF-R, Schedule 1, indicating gallons acquired from each supplier.

sit Authorities. For each product code, you must complete a separate

Form MF-D, Schedule 10, indicating gallons sold to each customer.

Line 3. Receipts at all marketing locations in Massachusetts

from sources within Massachusetts. Enter receipts at all market-

Line 15. Gain or loss. This line should include only stock loss or

ing locations in Massachusetts from sources within the state. For

gain inherent in the storage, maritime/pipeline transportation and

each product code, you must complete a separate Form MF-R,

marketing of gasoline. Losses of an unusual nature should be shown

Schedule 2, indicating gallons acquired from each supplier. You

on line 14, as described above. (Show gain in red and deduct).

must also indicate whether these gallons were acquired tax-free or

Line 17. Net taxable sales. Enter all sales on which the Massachu-

with the Massachusetts tax included.

setts excise tax is due. You are required to list all customers and the

Line 4. Direct shipments to other states. Enter the total of all

total gallons sold to each.

gasoline acquired and shipped directly from the reporting company’s

Line 18. Taxable gallons consumed or used. Enter total gallons

own refineries or suppliers in this state to points outside the state

of gasoline consumed or used by the reporting company for taxable

without being physically received or handled through the company’s

purposes.

marketing locations in this state. For each product code, you must

complete a separate Form MF-R, Schedule 3, indicating gallons ac-

Tax Computation

quired from each supplier.

Line 21. Adjustments. Enter any adjustments to previous months’

returns (additions in red). A statement explaining any adjustments

Line 5. Direct shipments to customers in Massachusetts. Enter

must be attached to the return.

the total of all gasoline received and shipped directly from the report-

ing company’s suppliers in this state or in any other state or from

Line 22. Tax-paid purchases. Enter the total of all Massachusetts.

the reporting company’s location in another state to any customer in

tax-paid purchases.

this state without being physically received or handled through the

Line 23. U.S. Government and foreign consulate sales. Enter

reporting company’s marketing locations in this state. For each prod-

courtesy card sales made to the United States Government or to for-

uct code, you must complete a separate Form MF-R, Schedule 4,

eign consulates by the company’s retail outlets from whom the re-

indicating gallons acquired from each supplier.

porting company collects tax at time of sale (see TIR 87-5). For each

Line 6. Other receipts. Enter all gallonage not previously reported

product code, you must complete a separate Form MF-D, Schedule

for which the reporting company is to be held accountable. For each

11, indicating gallons sold to each U.S. Government agency or for-

product code, you must complete a separate Form MF-R, Schedule

eign consulate.

printed on recycled paper

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2