Form 4579 - Michigan Business Tax Qualified Affordable Housing Seller'S Deduction - 2013

ADVERTISEMENT

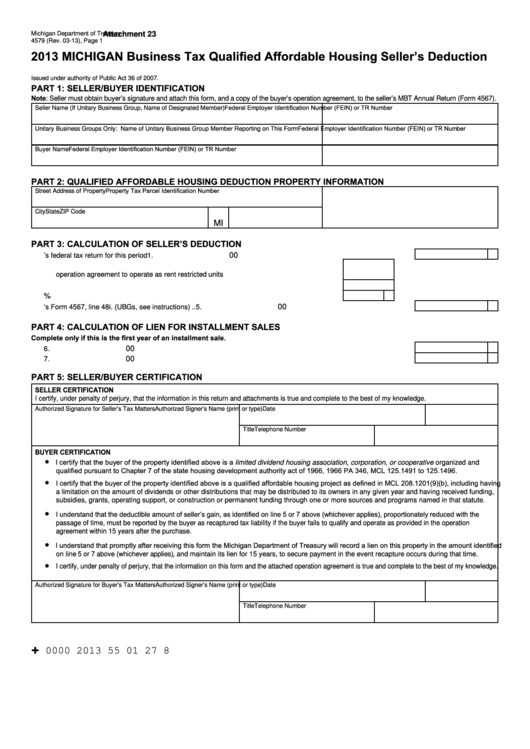

Michigan Department of Treasury

Attachment 23

4579 (Rev. 03-13), Page 1

2013 MICHIGAN Business Tax Qualified Affordable Housing Seller’s Deduction

Issued under authority of Public Act 36 of 2007.

PART 1: SELLER/BUYER IDENTIFICATION

Note: Seller must obtain buyer’s signature and attach this form, and a copy of the buyer’s operation agreement, to the seller’s MBT Annual Return (Form 4567).

Federal Employer Identification Number (FEIN) or TR Number

Seller Name (If Unitary Business Group, Name of Designated Member)

Federal Employer Identification Number (FEIN) or TR Number

Unitary Business Groups Only: Name of Unitary Business Group Member Reporting on This Form

Federal Employer Identification Number (FEIN) or TR Number

Buyer Name

PART 2: QUALIFIED AFFORDABLE HOUSING DEDUCTION PROPERTY INFORMATION

Property Tax Parcel Identification Number

Street Address of Property

City

State

ZIP Code

MI

PART 3: CALCULATION OF SELLER’S DEDUCTION

00

1. Gain from the sale as reported on seller’s federal tax return for this period ..........................................................

1.

2. Number of residential rental units in this property that the buyer committed in the

operation agreement to operate as rent restricted units .................................................

2.

3. Total number of residential rental units in this property ....................................................

3.

%

4. Divide line 2 by line 3 and enter as a percentage.............................................................

4.

00

5. Multiply line 1 by the percentage on line 4. Carry to the seller’s Form 4567, line 48i. (UBGs, see instructions) ..

5.

PART 4: CALCULATION OF LIEN FOR INSTALLMENT SALES

Complete only if this is the first year of an installment sale.

00

6. Total gain over life of installment note ...................................................................................................................

6.

00

7. Multiply line 6 by the percentage on line 4 ............................................................................................................

7.

PART 5: SELLER/BUYER CERTIFICATION

SELLER CERTIFICATION

I certify, under penalty of perjury, that the information in this return and attachments is true and complete to the best of my knowledge.

Authorized Signature for Seller’s Tax Matters

Authorized Signer’s Name (print or type)

Date

Title

Telephone Number

BUYER CERTIFICATION

I certify that the buyer of the property identified above is a limited dividend housing association, corporation, or cooperative organized and

n

qualified pursuant to Chapter 7 of the state housing development authority act of 1966, 1966 PA 346, MCL 125.1491 to 125.1496.

I certify that the buyer of the property identified above is a qualified affordable housing project as defined in MCL 208.1201(9)(b), including having

n

a limitation on the amount of dividends or other distributions that may be distributed to its owners in any given year and having received funding,

subsidies, grants, operating support, or construction or permanent funding through one or more sources and programs named in that statute.

I understand that the deductible amount of seller’s gain, as identified on line 5 or 7 above (whichever applies), proportionately reduced with the

n

passage of time, must be reported by the buyer as recaptured tax liability if the buyer fails to qualify and operate as provided in the operation

agreement within 15 years after the purchase.

I understand that promptly after receiving this form the Michigan Department of Treasury will record a lien on this property in the amount identified

n

on line 5 or 7 above (whichever applies), and maintain its lien for 15 years, to secure payment in the event recapture occurs during that time.

I certify, under penalty of perjury, that the information on this form and the attached operation agreement is true and complete to the best of my knowledge.

n

Authorized Signature for Buyer’s Tax Matters

Authorized Signer’s Name (print or type)

Date

Title

Telephone Number

+

0000 2013 55 01 27 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2