Instructions For Form 4579 - Michigan Business Tax (Mbt) Qualified Affordable Housing Seller'S Deduction

ADVERTISEMENT

4579, Page 2

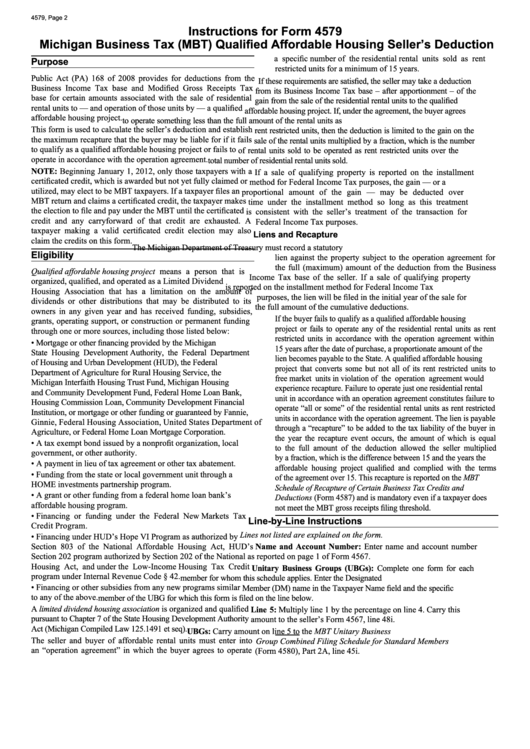

Instructions for Form 4579

Michigan Business Tax (MBT) Qualified Affordable Housing Seller’s Deduction

a specific number of the residential rental units sold as rent

Purpose

restricted units for a minimum of 15 years.

Public Act (PA) 168 of 2008 provides for deductions from the

If these requirements are satisfied, the seller may take a deduction

Business Income Tax base and Modified Gross Receipts Tax

from its Business Income Tax base – after apportionment – of the

base for certain amounts associated with the sale of residential

gain from the sale of the residential rental units to the qualified

rental units to — and operation of those units by — a qualified

affordable housing project. If, under the agreement, the buyer agrees

affordable housing project.

to operate something less than the full amount of the rental units as

This form is used to calculate the seller’s deduction and establish

rent restricted units, then the deduction is limited to the gain on the

the maximum recapture that the buyer may be liable for if it fails

sale of the rental units multiplied by a fraction, which is the number

to qualify as a qualified affordable housing project or fails to

of rental units sold to be operated as rent restricted units over the

operate in accordance with the operation agreement.

total number of residential rental units sold.

NOTE: Beginning January 1, 2012, only those taxpayers with a

If a sale of qualifying property is reported on the installment

certificated credit, which is awarded but not yet fully claimed or

method for Federal Income Tax purposes, the gain — or a

utilized, may elect to be MBT taxpayers. If a taxpayer files an

proportional amount of the gain — may be deducted over

MBT return and claims a certificated credit, the taxpayer makes

time under the installment method so long as this treatment

the election to file and pay under the MBT until the certificated

is consistent with the seller’s treatment of the transaction for

credit and any carryforward of that credit are exhausted. A

Federal Income Tax purposes.

taxpayer making a valid certificated credit election may also

Liens and Recapture

claim the credits on this form.

The Michigan Department of Treasury must record a statutory

Eligibility

lien against the property subject to the operation agreement for

the full (maximum) amount of the deduction from the Business

Qualified affordable housing project means a person that is

Income Tax base of the seller. If a sale of qualifying property

organized, qualified, and operated as a Limited Dividend

is reported on the installment method for Federal Income Tax

Housing Association that has a limitation on the amount of

purposes, the lien will be filed in the initial year of the sale for

dividends or other distributions that may be distributed to its

the full amount of the cumulative deductions.

owners in any given year and has received funding, subsidies,

If the buyer fails to qualify as a qualified affordable housing

grants, operating support, or construction or permanent funding

project or fails to operate any of the residential rental units as rent

through one or more sources, including those listed below:

restricted units in accordance with the operation agreement within

• Mortgage or other financing provided by the Michigan

15 years after the date of purchase, a proportionate amount of the

State Housing Development Authority, the Federal Department

lien becomes payable to the State. A qualified affordable housing

of Housing and Urban Development (HUD), the Federal

project that converts some but not all of its rent restricted units to

Department of Agriculture for Rural Housing Service, the

free market units in violation of the operation agreement would

Michigan Interfaith Housing Trust Fund, Michigan Housing

experience recapture. Failure to operate just one residential rental

and Community Development Fund, Federal Home Loan Bank,

unit in accordance with an operation agreement constitutes failure to

Housing Commission Loan, Community Development Financial

operate “all or some” of the residential rental units as rent restricted

Institution, or mortgage or other funding or guaranteed by Fannie,

units in accordance with the operation agreement. The lien is payable

Ginnie, Federal Housing Association, United States Department of

through a “recapture” to be added to the tax liability of the buyer in

Agriculture, or Federal Home Loan Mortgage Corporation.

the year the recapture event occurs, the amount of which is equal

• A tax exempt bond issued by a nonprofit organization, local

to the full amount of the deduction allowed the seller multiplied

government, or other authority.

by a fraction, which is the difference between 15 and the years the

• A payment in lieu of tax agreement or other tax abatement.

affordable housing project qualified and complied with the terms

• Funding from the state or local government unit through a

of the agreement over 15. This recapture is reported on the MBT

HOME investments partnership program.

Schedule of Recapture of Certain Business Tax Credits and

• A grant or other funding from a federal home loan bank’s

Deductions (Form 4587) and is mandatory even if a taxpayer does

affordable housing program.

not meet the MBT gross receipts filing threshold.

• Financing or funding under the Federal New Markets Tax

Line-by-Line Instructions

Credit Program.

Lines not listed are explained on the form.

• Financing under HUD’s Hope VI Program as authorized by

Section 803 of the National Affordable Housing Act, HUD’s

Name and Account Number: Enter name and account number

Section 202 program authorized by Section 202 of the National

as reported on page 1 of Form 4567.

Housing Act, and under the Low-Income Housing Tax Credit

Unitary Business Groups (UBGs): Complete one form for each

program under Internal Revenue Code § 42.

member for whom this schedule applies. Enter the Designated

• Financing or other subsidies from any new programs similar

Member (DM) name in the Taxpayer Name field and the specific

to any of the above.

member of the UBG for which this form is filed on the line below.

A limited dividend housing association is organized and qualified

Line 5: Multiply line 1 by the percentage on line 4. Carry this

pursuant to Chapter 7 of the State Housing Development Authority

amount to the seller’s Form 4567, line 48i.

Act (Michigan Compiled Law 125.1491 et seq).

UBGs: Carry amount on line 5 to the MBT Unitary Business

The seller and buyer of affordable rental units must enter into

Group Combined Filing Schedule for Standard Members

an “operation agreement” in which the buyer agrees to operate

(Form 4580), Part 2A, line 45i.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1