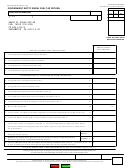

Form Ft-505.1 - Government Entity Credit Card Refund Or Credit Election Page 2

ADVERTISEMENT

FT‑505.1 (11/11) (back)

Certification of the designated credit card issuer or fuel distributor —

Pursuant to this election form, the credit card issuer or fuel

distributor certifies that:

• The excise, petroleum business, and sales taxes for which claims for refund or credit will be submitted were reported and paid to the Tax

Department.

• No refund or credit was previously claimed or allowed on any portion of the purchases to which this election relates.

• The credit card issuer or fuel distributor believes in good faith that the credit card purchases of fuel to which this election relates are for the

government entity’s own use and consumption.

• The credit card issuer has not charged, and will not charge the government entity any excise, petroleum business, or sales taxes. The fuel

distributor has not received from the government entity any excise, petroleum business, or sales taxes.

• The credit card issuer or fuel distributor can establish that the excise, petroleum business, and sales taxes have been repaid to the retail

station or other vendor or that it has received written consent from the retail station or other vendor to receive the refund or credit for the

taxes.

• The credit card issuer or fuel distributor will maintain detailed transactional and jurisdictional information for the credit card fuel purchases to

which this election relates and will provide that information to the Tax Department upon request.

• If a credit card issuer enters into contracts with more than one fuel distributor, or if a fuel distributor is to be added or dropped, the issuer

must provide (upon request) updated information regarding the fuel distributors that accept the issuer’s credit card.

• The credit card issuer or fuel distributor claiming the refund or credit is registered with the Tax Department. No refund or credit will be

allowed for any entity that is not registered. To register, see Form DTF-17, Application to Register for a Sales Tax Certificate of Authority.

• With regard to this election, the credit card issuer or fuel distributor understands that any credit card purchase of fuel that is not for the

government entity’s own use or consumption will result in a notice of ineligibility, after which, the taxes must be charged to the government

entity and the government entity must then apply for its own refunds.

Certification:

I certify that the above statements are true and correct and that no material information has been omitted. I make these

statements with the knowledge that willfully providing false or fraudulent information on this document with the intent to evade tax may

constitute a felony or other crime under New York State Tax Law, punishable by a substantial fine and possible jail sentence; and understand

that the Tax Department is authorized to investigate the validity of the credit or refund claimed and the accuracy of any information provided

with this claim.

Type or print name of owner, partner, etc., of credit card issuer or fuel distributor

Official title

Signature of owner, partner, etc., of credit card issuer or fuel distributor

Date

Mail to: NYS TAX DEPARTMENT

TDAB — FUELS UNIT

PO BOX 5501

ALBANY NY 12205

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2