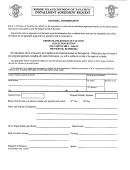

Print

Clear

Page 1

GA-9465

(Rev. 2/2013)

Form

MAIL TO:

Georgia Department of Revenue

Processing Center

Georgia Department of Revenue

PO Box 740396

Installment Agreement Request

Atlanta, GA 30374-0396

1.

L

If you received a notice showing an amount due, please enter the Letter ID number listed on the notice (if available):

2.

Check tax type and enter the related tax identification number and tax periods at issue:

SSN:

FEIN:

Individual Income Tax

-

-

Corporate

-

Income Tax

STN:

IFTA: GA

Sales and Use Tax

IFTA Fuel Tax

WTN:

TAX ID:

-

Other

Withholding Tax

Enter tax periods at issue:

3.

Taxpayer’s First Name

Middle Initial Last Name

Social Security Number

If a joint liability, Spouse’s First Name

Middle Initial Last Name

Social Security Number

Business Name

Federal Employer Identification No.

(use if business is requesting installment payment agreement)

Taxpayer’s Mailing Address

City

State

ZIP

Phone Number

4.

Enter the total amount you owe as shown on your tax return or notice: _______________________

5.

Enter the total number of months subject to the installment payment agreement, not to exceed 36 months:

.

6.

Enter the amount you will pay each month:

7.

st

th

Enter the day (1

to 28

) your monthly payment will be debited from your bank account:

.

All payments must be made by electronic funds withdrawal from your checking account. Complete the following information:

8.

Name of Financial Institution

Address

City

State

ZIP

a.

Routing Number:

Checking

Savings

b.

Account Number:

9.

I hereby waive all rights of any additional notice or appeal concerning the assessment and collection of any part or all of the tax liability to

be paid by means of this installment payment agreement request. I specifically waive the 30 day period to contest any notice of proposed

assessment issued under O.C.G.A. § 48-2-46 and the right to appeal any final assessment notice issued under O.C.G.A § 48-2-47.

I authorize the Georgia Department of Revenue and its designated financial agent to initiate a monthly ACH electronic funds withdrawal entry to the

financial institution account indicated above for payments of the state taxes owed and the financial institution to debit the entry to this account. I also

authorize the financial institutions involved in the processing of electronic payments of taxes to receive confidential information necessary to answer

inquires and resolve issues related to those payments. By mutual agreement, it is understood that any tax refund, state or federal, will be applied

through offset to the liability included in this payment agreement request until such is fully paid and satisfied. Your signature acknowledges that

you have waived all rights of any additional notice, refund, or appeal concerning the assessment and collection of any part or all of the

tax liability to be paid by means of this installment payment agreement request.

Your Signature

Date

Spouse’s Signature (if a joint return, both must sign)

Date

1

1 2

2 3

3