Print

Clear

Page 2

GA-9465

(Rev. 2/2013)

Form

Specific Instructions

To avoid processing delays,

•

Line 8a

Provide all requested information. If you are making

this

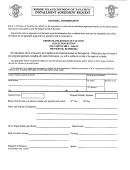

The routing number must be nine digits. The first two digits of

request for a joint tax return, show the names and social

the routing number must be 01 through 12 or 21 through 32.

security numbers (SSNs) in the same order as on your tax

Use a check to verify the routing number. On the sample

return. If you are making this request for a business, show

the name of the person responsible for paying any sales or

check on this page, the routing number is 250250025. But if

your check is payable through a financial institution do not use

withholding taxes and the related social security numbers on

the routing number on that check. Instead, contact your

line 3.

financial institution for the correct routing number.

Do not

use the routing number indicated on your deposit slip.

Line 1

If you received a notice from the Department showing an

Line 8b

amount due, enter the Letter ID listed on the notice. Doing so

The account number can be up to 17 characters (both

will help the Department process your request.

numbers and letters). Include hyphens but omit spaces and

Line 2

special symbols. Enter the number from left to right and leave

any unused boxes blank. On the sample check below, the

Check the box to identify the tax type for the installment

payment agreement request and the corresponding tax identifi-

account number is 20202086. Do not include the check

cation number.

number.

Line 4

Enter the total amount you owe as shown on your tax return

or notice.

Line 5

Enter the total number of months subject to the installment

payment agreement not to exceed 36 months.

Line 6

Enter the amount you can pay each month. Interest and

(line 8a)

(line 8b)

penalties will continue to accrue until you pay in full.

Line 7

Enter the day your monthly payment will be debited from your

bank account (1st to the 28th).

Line 9

You (or in the case of a business, the person responsible for

Line 8

remitting payments) must sign the statement. This signature

In order to pay by electronic funds withdrawal from your check-

authorizes the Georgia Department of Revenue to use the

ing account at a bank or other financial institution (such as

information on this form to make monthly withdrawals from the

mutual fund, brokerage firm, or credit union), you must fill in all

account listed in Line 8. This authorization remains in force

information requested in line 8. Check with your financial

until the Department receives written notification from you.

institution to make sure that an electronic funds withdrawal is

Your signature also acknowledges that you have waived all

allowed and to get the correct routing and account numbers.

rights of any additional notice, refund, or appeal concerning

Attach a blank check to your installment payment request and

the assessment and collection of any part or all of the tax

mark “VOID” across the front.

liability to be paid by means of this installment agreement

request.

1

1 2

2 3

3