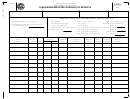

Form L-2110 - Motor Fuel Tankwagon Importers Monthly Return Page 3

ADVERTISEMENT

INSTRUCTIONS FOR L-2110 TANKWAGON IMPORTERS'

MONTHLY RETURN

Provide all information requested on the user fee return.

DUE DATE - The return is due on the 22nd of the next month.

LINE 1 - GALLONS RECEIVED USER FEE - OTHER APPLICABLE FEES PAID - (L-2111, SCHEDULE 1A)

Enter the number of gallons received user fee paid with South Carolina destination, from a South Carolina

licensed Terminal Supplier.

LINE 2 -

GALLONS IMPORTED SOUTH CAROLINA USER FEE AND OTHER APPLICABLE FEES FREE BY

TANKWAGON (L-2111, SCHEDULE 3-A)

Enter the number of gallons imported South Carolina user fee and other applicable fee free by tankwagon from

a location outside of South Carolina.

LINE 3 -

TOTAL GALLONS RECEIVED (LINE 1 + LINE 2)

Add the total gallons received user fee-fee paid (Line 1) and the gallons imported South Carolina user fee and

other applicable fee free (Line 2) to calculate the total gallons of motor fuel received.

GALLONS SOLD - DYED FUEL (L-2120, SCHEDULE 6-F)

LINE 4 -

Enter the number of gallons of dyed fuel sold in South Carolina.

LINE 5 -

GALLONS SOLD TO THE US GOVERNMENT (L-2120, SCHEDULE 8)

Enter the number of gallons sold to the US Government in South Carolina.

LINE 6 -

GALLONS SOLD TO THE SC DEPT OF EDUCATION SCHOOL BUSES (L-2120, SCHEDULE 9-C)

Enter the number of gallons sold for use in state owned school buses and service vehicles used in the pupil

transportation program.

LINE 7 -

GALLONS SOLD OTHER EXEMPT SALES (L-2120, SCHEDULE 10)

Enter the number of gallons sold for other exempt sales not covered under another schedule. This schedule

does not include dyed fuel sales. Please attach an explanation to the schedule for these sales.

TOTAL GALLONS SOLD USER FEE EXEMPT (TOTAL OF LINE 4 THROUGH LINE 7)

LINE 8 -

Add gallons sold dyed fuel (Line 4), gallons sold to the US Government (Line 5), gallons sold to the SC

Department of Education school bus transportation program (Line 6) and gallons sold for other exempt sales

(Line 7) to calculate the total exempt gallons sold.

LINE 9 -

GALLONS SOLD SUBJECT TO USER FEE (LINE 3 - LINE 8)

Subtract the total gallons sold user fee exempt (Line 8) from the total gallons received (Line 3) to calculate the

gallons sold subject to user fee.

LINE 10 -

NET GALLONS SOLD SUBJECT TO USER FEE (LINE 9 - LINE 1)

Subtract the user fee paid gallons received (Line 1) from the gallons sold subject to user fee (Line 9) to

calculate the net gallons sold subject to user fee.

LINE 11 -

TOTAL GALLONS SUBJECT TO OTHER APPLICABLE FEES (LINE 2 - LINE 5)

Subtract the gallons sold to the US Government (Line 5) from the gallons imported user fee and other

applicable fee free into South Carolina (Line 2) to calculate the total gallons subject to other applicable user

fees.

LINE 12 -

MOTOR FUEL USER FEES DUE (LINE 10 X $0.16)

Multiply the net gallons sold subject to user fee (Line 10) by $0.16 to calculate motor fuel user fees due.

LINE 13 -

TARE ALLOWANCE (LINE 9 X 0.00424)

Multiply Line 9 by 0.00424 to calculate the tare allowance for gasoline and low sulfur diesel. The maximum tare

allowance allowed for both product types is $2,000.00.

45331014

L-2110 I

(Rev. 11/3/11)

4533

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10