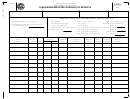

Form L-2110 - Motor Fuel Tankwagon Importers Monthly Return Page 4

ADVERTISEMENT

TANKWAGON IMPORTERS' MONTHLY USER FEE AND OTHER

APPLICABLE FEE CALCULATION INSTRUCTIONS

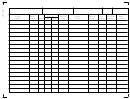

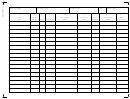

USER FEE DUE - LINES 1 AND 8

Line 1 - Enter the user fee amount listed for gasoline from line 12 of the user fee return.

Line 8 - Total the amounts for all other product types listed on Line 12 of the user fee return to calculate the total

special fuel user fee due.

LESS TARE ALLOWANCE - LINES 2 AND 9

(Total of lines 2 and 9 must not exceed $2,000.00)

Line 2 - Enter the tare allowance listed on Line 13 of the user fee return for gasoline. If the gasoline tare allowance

exceeds $2,000.00, enter $2,000.00 on Line 2 and zero on Line 9. If the gasoline tare allowance is less than

$2,000.00, enter the amount on Line 2 and calculate the special fuel tare allowance for Line 9.

Line 9 -

Use the tare allowance for low sulfur diesel listed on Line 13 of the user fee return. If Line 2 was $2,000.00

enter zero on Line 10. If Line 2 was less than $2,000.00, enter the appropriate amount on Line 9. The total of

Line 2 and Line 9 can not exceed $2,000.00.

LESS CREDIT - LINES 3, 10, 16, AND 22

Enter any amounts for which you are taking credit for user fees or other applicable fees paid. You must attach an

explanation for the credit.

NET USER FEES DUE - LINES 4 AND 11

Calculate the net user fee amounts due by subtracting the tare allowance (Lines 2 and 9) and the credit amount (Lines 3

and 10) from the user fee due amount (Lines 1 and 8).

INSPECTION FEES DUE - LINE 15

Total the gallons for all product types listed on Line 11 of the user fee return to calculate the total gallons subject to fees.

Then multiply the total by $.0025.

ENVIRONMENTAL IMPACT FEES DUE - LINE 21

Total the gallons for all product types listed on Line 11 of the user fee return to calculate the total gallons subject to fees.

Then multiply the total by $.0050.

PENALTY - LINES 5, 12, 18 AND 24

INTEREST - LINES 6, 13, 19 AND 25

TOTALS DUE - LINES 7, 14, 20 AND 26

Add any penalty (Lines 5, 12, 18, 24) and interest due (Lines 6, 13, 19, 25) to the user fees and other applicable fees

calculated (Lines 4, 11, 15, 21) and enter the total payment to be made for each user fee/other applicable fee due.

TOTAL USER FEE AND OTHER APPLICABLE FEES DUE - LINE 25

Add the total due lines together (Lines 7, 14, 20, 26) to calculate the total payment to be made with the user fee return.

If you have any questions or need assistance calculating penalty and interest, please call this office at (803) 896-1990.

MAIL TO: Make the check payable to the SC Department of Revenue and mail to SC Department of Revenue, Motor

Fuel, Columbia SC 29214-0132.

45332012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10