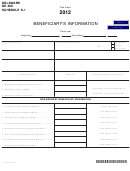

MARYLAND

FIDUCIARY MODIFIED

page 2

FORM

SCHEDULE K-1

504

BENEFICIARY’S INFORMATION

Schedule K-1

Complete A Separate Form For Each

2013

Beneficiary

NAMe _______________________________ FeIN ________________________

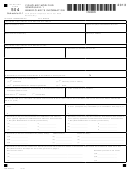

7. One Maryland Economic Development Tax Credit from Business Tax Credit Form 504CR.

£

£

Refundable

Nonrefundable

1a. Total number of “qualified employees” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1a. ___________________

1b. If the amount on line 1a is less than 25, has the PTE maintained at least 25 qualified employees

for at least 5 years?

Yes

No

2. Tax year in which the project was put into service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. __________________

Enter Member’s Distributive or Pro Rata Share of the Following:

3. Portion of PTE’s income attributable to project . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. __________________

4. Non-project taxable income from PTE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. __________________

5. Number of “qualified employees” multiplied by $10,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5. __________________

6. Amount of Maryland income tax required to be withheld from employees

reported on line 1a of this form. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. __________________

7. Total eligible cumulative project costs ($500,000 PTE minimum, $5,000,000 PTE maximum) . . . .7. __________________

8. Total cumulative eligible start-up costs ($500,000 PTE maximum) . . . . . . . . . . . . . . . . . . . . . . 8. __________________

If additional space is needed for any item, attach a separate schedule.

Maryland Source Income for a Nonresident Beneficiary

**A nonresident is subject to tax on income from Maryland sources, which includes any income derived from real property or tangible per-

sonal property in Maryland; income derived from a business wholly or partially carried on in Maryland and in which the trust or estate is a

member of a pass-through entity; income from an occupation, profession or trade carried on wholly or partially in Maryland; and income

from wagering in Maryland.

COM/RAD-320

13-49

1

1 2

2 3

3