Alabama ET-1 – 2012

120004E1

Page 4

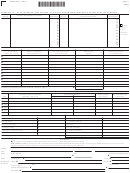

Schedule M – Federal Income Tax (FIT) Deduction/(Refund)

(a) Taxpayers filing separate (nonconsolidated) federal returns should enter on line

If this corporation is a member of an affiliated group which files a consolidated federal re-

6 below the amount of federal income tax actually paid during the year.

turn, indicate the number of the election made under IRC §1552.

•

1552(a)(1) •

1552(a)(2) •

1552(a)(3) •

No Election Made

(b) Methods 1552(a)(1) or 1552(a)(2), enter on line 6 the amount of the consoli-

•

Other

dated tax allocated to this corporation from line 5.

1552(a)(1) enter separate company income from line 30 of the proforma 1120 for this com-

(c) If using Method 1552(a)(3), enter on line 6 the amount of the consolidated tax

pany on line 1.

allocated to this corporation. Attach a schedule of your computations. Ignore

1552(a)(2) enter separate company tax from line 31 of the proforma 1120 for this company

any supplemental elections under IRC §1502.

on line 1.

•

1

1 This company’s separate federal (taxable income/tax). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

2

2 Total positive consolidated federal (taxable income/tax) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

3

3 This company’s percentage (divide line 1 by line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

•

4 Consolidated federal income tax paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

•

5

5 Federal income tax for this company (multiply line 3 by line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

6 Federal income tax to be apportioned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

•

7

7 Alabama income before federal income tax deduction, page 1, line 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

8

8 Adjusted total income, page 1, line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

9

9 Federal income tax ratio (divide line 7 by line 8). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

•

10

10 Federal income tax apportioned to Alabama (multiply line 6 by line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

11

11 Less refunds or adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

12

12 Net federal income tax deduction / <refund> (enter on page 1, line 28) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Information

1 Briefly describe your Alabama operations.

2 List other states in which corporation operates, if applicable.

3 If this taxpayer is a member of an affiliated group which files a consolidated federal return, the following information must be provided:

(a) Copy of Federal Form 851, Affiliations Schedule. Identify by asterisk or underline the names of those corporations subject to tax in Alabama.

(b) Signed copy of consolidated Federal Form 1120, pages 1-5, as filed with the IRS.

(c) Copy of the spreadsheet of income statements; all supporting schedules for all legal entities that file as part of the consolidated federal group including (but not

limited to) a copy of the spreadsheet of income statements (which includes a separate column that identifies the elminations and adjustments used in completing the federal

consolidated return), beginning and ending balance sheets, Schedule M-3 for the entire federal consolidated group.

(d) Copy of federal Schedule K-1 for each tax entity that the corporation holds an interest in at any time during the taxable year.

(e) Copy of federal Schedule(s) UTP.

4 Are you currently being audited by the IRS?

Yes

No

5 Location of the corporate records:

Street address:

City:

State:

Zip Code:

Mail to: Alabama Department of Revenue

Individual and Corporate Tax Division

FIET Unit

PO Box 327439

Montgomery, AL 36132-7439

RETURN AND TAX DUE BY APRIL 15, 2012

ADOR

1

1 2

2 3

3 4

4