2014 Form 38-ES, page 2

North Dakota Offi ce of State Tax Commissioner

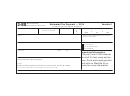

2014 estimated income tax worksheet—estate or trust

1. Estimated federal taxable income for the 2014 tax year (from worksheet in 2014 Federal Form 1041-ES) .......................... 1 ___________________

2. Addition adjustments—see the instructions to the 2013 Form 38, Tax Computation Schedule, line 2, for required

adjustments ............................................................................................................................................................................... 2 ___________________

3. Balance (Add lines 1 and 2) ..................................................................................................................................................... 3 ___________________

4. Subtraction adjustments—see the instructions to the 2013 Form 38, Tax Computation Schedule, line 4, for allowable

adjustments ............................................................................................................................................................................... 4 ___________________

5. North Dakota taxable income (Subtract line 4 from line 3) ..................................................................................................... 5 ___________________

6. North Dakota income tax—calculate the tax for the amount on line 5 as follows .................................................................. 6 ___________________

•

If a resident estate or trust, calculate the tax using the 2014 Tax Rate Schedule below.

•

If a nonresident estate or trust, complete lines 15 through 19 below.

7. Credits—see the instructions to the 2013 Form 38, page 1, line 3, for allowable credits ........................................................ 7 ___________________

8. Net tax liability (Subtract line 7 from line 6) ........................................................................................................................... 8 ___________________

9. Estimated North Dakota income tax withholding for the 2014 tax year .................................................................................. 9 ___________________

10. Balance due (Subtract line 9 from line 8) If the amount on this line is less than $1,000, stop here;

no estimated tax is due ............................................................................................................................................................. 10 ___________________

11. Multiply line 8 by 90% (.90) [or 66 2/3% (.6667) if a qualifi ed farmer] ..................................... 11 ___________________

12. Net tax liability from 2013 Form 38, page 1, line 4. If no return was required for 2013,

enter 0. If the amount on this line is less than $1,000, stop here; no estimated tax is due .......... 12 ___________________

13. Enter the smaller of line 11 or line 12. However, if the estate or trust was not in existence for the entire 2013

tax year, enter the amount from line 11. If line 9 is equal to or greater than the amount on this line, stop here;

no estimated tax is due ............................................................................................................................................................. 13 ___________________

14. Minimum annual payment. (Subtract line 9 from line 13) Divide this amount by four to determine the amount to

pay on each installment due date. See Payment amounts and due dates in the instructions on page 1 for the

due dates and for exceptions to paying in four installments .................................................................................................... 14 ___________________

Nonresident estate or trust tax calculation only (lines 15 through 19)

15. Calculate the tax for the amount on line 5 using the 2014 Tax Rate Schedule below ............................................................. 15 ___________________

16. Income from North Dakota sources. Enter the portion of the fi duciary’s income that is

reportable to North Dakota (except U.S. obligation interest) ...................................................... 16 ___________________

17. Estimated total income of fi duciary (reduced by U.S. obligation interest) .................................. 17 ___________________

18. North Dakota income ratio (Divide line 16 by line 17. Round to nearest two decimal places.) ............................................. 18

___________

19. Multiply line 15 by line 18. Enter this amount on line 6 above .............................................................................................. 19 ___________________

2014 Tax Rate Schedule

Estate or Trust

If North Dakota

taxable income is:

Your tax is equal to:

Over

But not over

$

0 $

2,500 ............... 1.22% of North Dakota taxable income

2,500

5,800 ... $

30.50 + 2.27% of amount over $

2,500

5,800

8,900 ...

105.41 + 2.52% of amount over

5,800

8,900

12,150 ...

183.53 + 2.93% of amount over

8,900

12,150 ...................... 278.76 + 3.22% of amount over

12,150

1

1 2

2 3

3 4

4