Form Sc 1120 - 'C' Corporation Income Tax Return Page 7

ADVERTISEMENT

Page 7

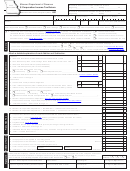

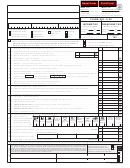

SC1120

SCHEDULE M

CONSOLIDATED RETURN AFFILIATIONS SCHEDULE

Include additional Schedule Ms as needed. Include only corporations doing business in SC.

Part 1

General Information

Is the Common Parent Corporation included in the return?

Yes

No

If NO, enter Name and Federal Employer Identification Number (FEIN) of Common Parent Corporation.

FEIN

NAME OF COMMON PARENT CORPORATION

FEIN

Name of Each Corporation Included in This Consolidated Return

Corporation 1

Corporation 2

Corporation 3

Corporation 4

Corporation 5

Corporation 6

Corporation 7

Corporation 8

Income Tax Information

Part 2

Federal Taxable

Amounts Directly

Amounts Allocated

SC Adjustments

SC NOL Prior

Allocated

Income

to SC

Year Carryovers

Corporation 1

$

$

$

$

$

Corporation 2

Corporation 3

Corporation 4

Corporation 5

Corporation 6

Corporation 7

Corporation 8

Total

Equals page 1, line 1

Equals Sch. F, line 7

Equals Sch. F, line 8

Equals page 1, line 2

Equals page 1, line 5

Part 3

License Fee, Allocation, and Apportionment Information

Tax Credited

Total Capital and

Apportionment

License Fee

on Return

Paid in Surplus

Percentage

$

$

$

Corporation 1

%

Corporation 2

Corporation 3

Corporation 4

Corporation 5

Corporation 6

Corporation 7

Corporation 8

Total

Equals page 1, line 14

Equals page 1, line 20

Per Schedule H

Equals page 1, line 21

30917025

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8