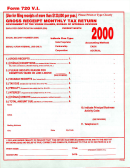

Form 4700 - Gross Receipts Worksheet Page 2

ADVERTISEMENT

FEIN or TR Number

4700, Page 2

UBG Member FEIN or TR Number

ADJUSTMENTS TO FEDERAL GROSS RECEIPTS

00

19. Gross Receipts as recorded on line 6, 12 or 18 ...............................................................................................

19.

PART 4: ADDITIONS TO GROSS RECEIPTS

To the extent EXCLUDED or DEDUCTED in arriving at the number used in line 19, include the following:

20. Proceeds from the sale of assets used in a business activity ...............................................................................

00

20.

21. Dividend and interest income ................................................................................................................................

00

21.

22. Receipts from gratuities stipulated on a bill ...........................................................................................................

00

22.

23. Receipts from gross commissions earned.............................................................................................................

00

23.

24. Receipts from client reimbursed expenses not obtained in an agency capacity ...................................................

00

24.

25. Gross proceeds from intercompany sales .............................................................................................................

00

25.

00

26. Rents .....................................................................................................................................................................

26.

00

27. Royalties ................................................................................................................................................................

27.

28. Sales of scrap and other similar items...................................................................................................................

00

28.

29. Other receipts not included in previous lines .........................................................................................................

00

29.

30. Add lines 20 through 29.........................................................................................................................................

00

30.

Add line 19 and line 30 .................................................................................................................

SUBTOTAL

00

31.

31.

PART 5: EXCLUSIONS FROM GROSS RECEIPTS

To the extent INCLUDED in arriving at line 31, enter the following receipts:

32. Proceeds from sales by a principal collected by the taxpayer in an agency capacity and delivered to the principal ....

00

32.

33. Amounts received on behalf of a principal that are received and expended by the taxpayer in an agency capacity

for the following:

a. Performance of service by third party for the benefit of the principal for service required by law to be performed by a

licensed person .................................................................................................................................................................... 33a.

00

b. Performance of service by a third party for the benefit of the principal that the taxpayer has not undertaken a

contractual duty to perform .................................................................................................................................................. 33b.

00

c. Payment of principal and interest under a mortgage loan or land contract, lease or rental payments, or taxes,

utilities, or insurance premiums relating to real or personal property owned or leased by the principal .................... 33c.

00

d. Capital asset that is or will become eligible for depreciation, amortization, or accelerated cost recovery by the

principal for federal income tax purposes, or real property owned or leased by the principal .................................... 33d.

00

e. Property not described above that is purchased by taxpayer on behalf of the principal, where taxpayer does

not take title to or use in the course of performing its contractual business activities ....................................... 33e.

00

f. Fees, taxes, assessments, levies, fines, penalties, or other payments established by law that are paid to a

governmental entity and that are the legal obligation of the principal ............................................................... 33f.

00

34. Amounts excluded from gross income of a foreign corporation engaged in the international operation of aircraft

under IRC § 883(a) ................................................................................................................................................

00

34.

35. Amounts received by advertising agency used to acquire advertising media time, space, production, or talent

on behalf of another person...................................................................................................................................

00

35.

36. Amounts received by a newspaper to acquire advertising space not owned by that newspaper in another

newspaper on behalf of another person, excluding any consideration received by taxpayer for acquiring that

advertising space...................................................................................................................................................

00

36.

37. Amounts received by taxpayer that manages real property owned by a third party that are deposited into a

separate account kept in the name of that third party and that are not reimbursements to the taxpayer and are

not indirect payments for management services that the taxpayer provides to that third party

00

37.

.................................

38. For taxpayers that during tax year do NOT both buy and sell any receivables, proceeds from the taxpayer’s

transfer of an account receivable, if the sale that generated that receivable was included in Gross Receipts for

Federal Income Tax purposes

00

38.

.................................................................................................................................................

39. Proceeds from original issue of stock or equity instruments or equity issued by a regulated investment

company as defined in IRC § 851

00

39.

...........................................................................................................................................

40. Proceeds from the original issue of debt instruments

00

40.

.........................................................................................................

41. Refunds from returned merchandise

00

41.

......................................................................................................................................

42. Cash and in-kind discounts ...................................................................................................................................

00

42.

Continued on Page 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5